If you thought that new transaction reporting requirements and a complete overhaul of exchange-traded derivatives operations were sufficiently arduous regulatory shifts then just wait until margining of non-cleared OTC derivatives arrives in September 2016 . Anywhere between $150 -$300 trillion in notional outstanding will need to be repapered, margined and collateralised. And that work hasn’t really started yet because the rules still have to be finalised. The basic principles are relatively straightforward. In 2011, two years after Pittsburgh, the G20 also ordained OTC derivatives, which were not sufficiently standardised for CCP clearing, should be subject to bilateral margin requirements. In September 2013 this resulted in the Basel Committee on Banking Supervision and IOSCO publishing the framework for minimum standards on margin requirements for non-centrally cleared OTC derivatives. This framework was then refined into regulatory technical standards by ESMA and other supervisory authorities in Europe and the Commodity Futures Trading Commission (CFTC) and other prudential regulators in the US. |

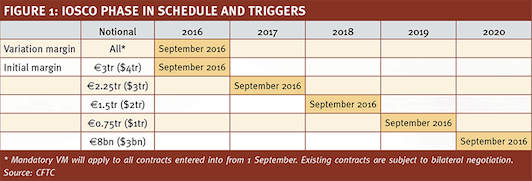

The framework identifies the main asset classes to be covered, namely credit, equities, rates, FX and commodities and set an initial implementation date of 1 December 2015. Just days before going to press with this edition, the Committee pushed back the deadline to September 2016, giving the market some breathing space, however the timeline will still be tight. This impending date is however, ameliorated by other considerations of size and product type for phasing in and it distinguishes between variation margin (VM) and initial margin (IM). The bilateral exchange of VM becomes effective for all in September 2016. The same start date applies for IM for major participants.

Thereafter the timetable is a sequence of declining thresholds. The first group needing to comply are major swaps market participants with an exposure of Ä3 trillion under ESMA or $4 trillion under CFTC as measured during the March-May period preceding 1 September 2016. Thereafter the threshold declines each successive year until September 2020 when most covered entities will have to comply.

Margin requirements do not apply to all OTC counterparties but to financial institutions and the larger non-financial counterparties deemed ‘systemically important non-financial entities’ by IOSCO. Robert Finney, partner in UK law firm Holman Fenwick Willan, suggests implementation “is likely to capture many non-financial entities that can scarcely be regarded as systemically important”. These firms will need to pay VM daily but the obligation to pay IM will depend on at least three further tests:

- Whether the entity has a “material exposure” – namely a group-wide uncleared OTC derivative exposure exceeding $3 billion in the US and €8 billion for EU firms

- Whether the initial consolidated margin due between counterparties exceeds a maximum of Ä50 million (EU) or $65 million (US)

- Whether the amount that would be transferred between parties would exceed certain agreed minimum margin transfer amounts: this is a de minimis figure to avoid the operational burden of small IM or VM payments. It must not exceed 1% of the initial margin threshold amount (i.e. €500,000 in the EU or $650,000 in the US).

Both the CFTC rules and those proposed by Europe’s regulators have the same timetable. However, there are at present variances between the two jurisdictions over eligible collateral and thresholds and some of the finer detail while a standard margin methodology still has to be agreed in both markets.

CFTC chairman Timothy Massad recently acknowledged that US rules needs to be consistent with other regimes. The lower US threshold planned for 2019 means the US rules could potentially capture a bigger pool of participants, though US rules exempt non-financial end-users. In Europe the exemption applies to so-called NFC-(non-financial counterparty) firms with derivatives notional below a certain threshold. However, a non-European end-user that would have been categorised as an NFC- firm if it had been domiciled in Europe would be treated as an NFC+ when trading with European banks and thereby become subject to the rules.

For end-users the practical tasks facing them to comply with the new margin rules are daunting. New documentation which clarifies a string of issues, such as margin rates and payment frequencies, tri-party involvements, collateral agreements and dispute resolution will have to be put in place. But the documentation only describes what will also physically need to be in place in terms of support technology and margin transfer mechanisms. For buy-side firms with no previous experience of margining and collateralising OTC activity, this represents a major challenge.

Many are not yet ready. In January ISDA presented the results of a survey of 400 firms engaged in non-cleared swaps from different sectors and countries. One third of the survey did not know whether they will be affected by the new regulations and 64% of the total said they were concerned about their ability to comply by December 1. This is despite the finding that 80% of the sample consider OTC derivatives, both cleared and uncleared, to be important in managing their firms’ risk strategies.

There is widespread recognition that repapering needs to start imminently and will be comprehensive. David White, product marketing executive at TriOptima, part of ICAP, considers that “The majority of existing collateral agreements will need to be amended, updated and may be replaced altogether in order to include terms which comply with the new rules.”

Matt Streeter, capital markets strategist at Fincad, describes the documentation challenge as tremendous. “The initial legal/compliance upgrade will be a heavy [cost] burden but the ongoing requirements to maintain a compliance audit will also drain resources.” Although much of the core documentation is based on ISDA master agreements, more contract and counterparty specific arrangements will also have to be worked up. And of course the additional problem of non-cleared derivatives is that by definition they are non-standard – otherwise they would be cleared – and present problems of agreeing valuation reference prices.

Andrea More, managing director, global markets collateral segregation and product development at Bank of New York Mellon explains, “Among Europe’s broker dealers it is estimated there are in excess of 4,700 legal entities which will be expected to post margin. They face major tasks, including building the new legal frameworks, establishing margin transfer and reconciliation systems and developing their third party custodian relationships before that can happen.”

As the paperwork is prepared so the operational business of building for margining begins. Both CFTC and ESMA proposals have rules for the posting of VM and IM and the eligible collateral which supports those. In both cases VM requirements go live for all covered swaps (except physically settled FX) on 1 September 2016. But here one major variance creeps in as the CFTC is proposing that only cash may be used for VM whereas ESMA proposals allow a range of eligible collateral from cash through bonds, equities and gold among others.

Other variances will be found in the detail for collateralising initial margin. Ultimately, eligible collateral under IOSCO will be defined by the national regulators in Europe and the US and there will be variations, though the major categories are broadly similar.T

The variances in these rules reflect some of the underlying regional legal practices. More points out that cash can be a pledged asset in the US whereas the legal basis for pledging cash in Europe is questionable. There are also capital ratios to consider for banks. She suggests that, “The bigger issue is that with Basel III implementation fewer banks will want cash deposits on their balance sheets.”

Both regulatory regimes allow a broad range of securities for IM, although haircuts will apply. The haircuts range from a modest 0.5-1.0% for short term government and corporate bonds to 15-25% for certain equities. This leads on to another challenge for asset managers and corporates wrestling with new concepts.

“Asset managers have tended to take a holistic view of risk management but the different margining and collateral management requirements between exchange-traded and OTC, for example, will require a changed methodology.” says More. “Where a range of securities can be used as margin collateral some participants will be familiar with the cheapest to deliver mechanism while others will have no such experience, but it is something they will need to develop as part of the transition.”

The implementation complexities during the 2016-2020 transition are daunting. Leaving aside cross-border variances firms such as major pension funds may need to accommodate pre- and post-threshold non cleared OTCs and CCP-cleared OTCs and possibly exchange traded derivatives into one over-arching risk management framework.

The regulations themselves describe the need to develop standardised margin models which are applicable across the OTC margining regimes. CCPs in the exchange-traded world have tended to calculate IM on the basis of the asset price volatility, historical and implied, whereas VM is a simpler, mark-to-market P&L adjustment. In this context any standardised margin model for IM in non-cleared OTCs may face the difficult challenge of finding consistent reference price histories, particularly for some of the more obscure assets.

Standardised margin models for the OTC component may not necessarily be sufficient for the risk management requirements of more complex portfolios. Large, multi-asset pension funds, for example, says Streeter, tend to apply more complex OTC derivatives to the business of de-risking their portfolios. “Many clients, particularly those using more complex contracts which are difficult to calibrate, will want a more sophisticated in-house model to analyse and manage their risk.”

The outlook is not all bleak however. Market participants are being encouraged to reduce overall risk exposures by compressing their OTC portfolios. Also known as ‘tear-ups’ compression works by matching long and short contracts with similar characteristics and closing out the equal and opposite fractions. This is happening both bilaterally and multi-laterally and is likely to increase as Basel III and more arduous capital ratios approach. However, although compression will reduce gross exposure it will not absolve participants from having the full suite of systems in place to manage the resulting net exposure. It is also harder to apply to the complex, exotic end of the OTC spectrum.

Some exemptions from the

timescales have also been secured, notably for pension funds where the

complexity of conformance in the timescales against their particular liability

profiles and risk management requirements has been recognised. The market

reacted positively to the nine-month delay for the implementation of the margin

requirements, however many would have preferred longer. Either way, there

remains a lot of work to do, and the extension doesn’t mean firms should put

preparation for the

new rules to the back of their minds.