Ade Cordell, president of Cboe NL, and David Howson, Cboe Europe president

Can you provide an overview of your plans in European derivatives?

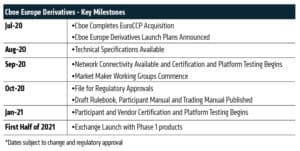

David Howson (DH): We’re planning to launch a new European equity derivatives venue, called Cboe Europe Derivatives, in the first half of 2021, subject to regulatory approvals.

This market will form part of our existing exchange in Amsterdam, Cboe NL, and will initially offer trading in futures and options based on six Cboe Europe equity indices: the Cboe Eurozone 50; Cboe UK 100; Cboe Netherlands 25; Cboe Switzerland 20; Cboe Germany 30; and Cboe France 40.

We plan to add futures and options on additional European benchmarks at a later date, based on customer demand. Ade Cordell, who joined us earlier this year, is overseeing our expansion into European derivatives and was appointed president of Cboe NL in July.

Our mission is to bring a modern, vibrant pan-European model to the region’s derivatives markets by leveraging Cboe’s global derivatives expertise, European equities footprint, and world-class technology. We think it is a market that is ripe for growth: We are not simply aiming to take market share from the existing exchanges. Our aim is to grow the overall derivatives market in Europe through an improved market design based on our successful US trading constructs, which existing and new participants are asking for.

It is notoriously challenging to build a new derivatives market from scratch. Why do you think Cboe will be successful?

DH: Having worked at Cboe Europe and its previous incarnations for many years, diversifying into the derivatives market is something we’ve always been working towards. We now have all the ingredients necessary to make that move with a unique proposition.

First, our pan-European cash equities business is well-established and highly successful. We continue to be Europe’s largest truly pan-European equities exchange by value traded, accounting for close to 20% of all activity on any given day. What this business has given us is robust market data, not just for one country but across all of Europe’s major markets – something no other European exchange can offer. We’ve used that data to calculate our own pan-European indices, which are highly correlated with comparable benchmarks. They serve as the foundation for our derivatives business, enabling us to create a suite of high-quality, proprietary equity index contracts in a cost-effective and consistent manner.

While we are aware we can’t simply replicate our equities model in derivatives, we can leverage some of the factors that have made it a success. Responding to client demands to positively disrupt a market and create a better, pan-European structure that benefits all participants is a principle that we apply to any asset class.

Second, being part of Cboe since 2017 has given us the opportunity to learn and benefit from the group’s deep expertise in the US equity derivatives market. Cboe has a long history of innovation in derivatives as founder of the listed options market in the US and has created numerous successful products. We’ll be using that expertise and repurposing Cboe’s US equity derivatives technology and market model as we develop our European market.

Third, there is latent client demand: We have had requests from both US and European market participants to bring a new derivatives market to Europe to help manage their equity exposures. There is also capacity in the market for new markets and products with major operational projects including MiFID II implementation and Brexit preparations completed.

Last, but by no means least, is our recent acquisition of EuroCCP, the leading pan-European cash equities clearing house. This offers us the clearing solution for our derivatives platform.

Can you tell us more about the opportunity you see specifically in equity derivatives?

Ade Cordell (AC): We believe there is an opportunity to bring competition to and grow the equity derivatives market in Europe. If you look at Chart 1, you can see striking differences in the size of the equity options markets in the US and Europe. Even though the European economy is similar in size to the US, the US equity options and equity index market has grown rapidly while Europe’s has stagnated.

We believe there are a few reasons for this lack of growth. The first is the fragmented nature of the market and limited amount of competition in European equity derivatives outside of single stock futures and options. Europe’s index market is essentially domestic – if investors want to trade German equity index derivatives they do so on the German exchange, if they want to trade Italian equity Index derivatives they use the Italian exchange and so on. Confining the market to national boundaries in this way has restricted its ability to grow and has also created inefficiencies for participants. In order to trade Europe’s key index products, participants currently need to connect to multiple venues and clearing houses, adhere to different pricing structures, and use different market models. That creates inefficiencies, at both a trading and clearing level.

Furthermore, the current market structure has also hindered growth, dominated as it is by a pre-arranged block trading model, or often referred to as a call-around market. Larger transactions are agreed off-exchange and reported on a delayed basis, resulting in limited on-screen liquidity. We have spoken to a number of frustrated systematic and quantitative hedge funds which look at Europe and say, for national index options in particular, it is nowhere near as liquid a market as it could be if the market structure was addressed.

Can you provide more details about the market model you will be using?

AC: We believe we have a better solution built upon the on-exchange market model adopted in Cboe’s US derivatives market. We are introducing a transparent, lit, quote-driven market designed to attract a diverse range of market participants, including retail and institutional investors. We have also designed our market from a pan-European point-of-view, enabling market participants to access a modern derivatives market through a single access point, creating efficiencies in trading and clearing.

On the product design front, we expect to offer uniform contracts to create efficiencies for customers. Our goal is to encourage deep pools of liquidity through homogenous products; all constructed the same way. We’ve developed right-sized index contracts with appropriately calibrated tick sizes for index futures and options contracts.

How has the build out been progressing and has COVID-19 disrupted your plans?

DH: We have been making very good progress on the regulatory, technology and operational development and expect to have the platform ready for network connectivity and initial customer testing in October. We’ve engaged vendors as well who are key in the derivatives market to make sure the connectivity is there for the first round of clients. We are in active discussions about some elements of the market design, including potential market maker protections and incentive schemes, and are holding a series of working groups with market making firms to ensure the best of the US-style market model is appropriately configured for the European marketplace. As we go through the rest of the year we will continue to conduct regular webinars with clients to showcase our plans for a more dynamic European equity derivatives market.

Clearly, getting in front of potential customers has been a little more difficult than it otherwise would have been – particularly during one of the most volatile trading periods in recent memory. That said, we have seen significant levels of interest from across the community, the feedback from the market makers in particular has been outstanding and we have commitment from trading and clearing members to be there on day one. Overall, we remain on track to launch in the first half of 2021.

You referred to efficiencies in clearing. Can you explain why the clearing layer is so fundamental to establishing a new derivatives market in Europe?

DH: Unlike equities, the vast majority of listed derivatives markets operate as vertical silos, meaning contracts trade and clear on platforms owned by the same group. While MiFID II contains so-called ‘open access’ provisions forcing clearing houses to connect to third party venues to promote competition at the trading level, these have been delayed until at least 2021. It is therefore considerably easier to launch a derivatives market in Europe if you own a clearing house.

That was a major factor behind our decision to fully acquire EuroCCP, which completed in July 2020. Increasing from a 20% shareholder to full ownership provides us with an immediate opportunity to innovate and meet market needs in a joined-up way with a first step being able to prioritise and direct the development of clearing capabilities for derivatives. This initiative is EuroCCP’s first venture outside cash equities and something we are all very excited about.

EuroCCP is currently working closely with its regulators on their necessary approvals, the technical build is progressing well and it will be ready to support Cboe Europe Derivatives through its early member testing in October. EuroCCP is intending to make it straightforward for both existing and new members to utilise the service and our combined model has inherent operational efficiencies by allowing users to connect to a single trading venue and clearing house for major European index exposures, versus having to connect to several domestic organisations currently.