CME FX futures and options have seen significant growth in both volumes and participation over the last few years. In 2022, on average over $80 billion of FX futures traded every day, with a total of $40 trillion notional centrally cleared across 40 currency pairs.

The benefits of centrally cleared futures in FX are increasingly being recognised. Drivers include margin efficiencies relative to non-cleared derivatives for buy-side firms caught by Uncleared Margin Rules, and capital efficiencies for banks under SA-CCR.

However, a common misconception that arises from discussions with clients surrounds liquidity, with many believing that FX futures are not liquid enough for them to transact and that OTC venues remain “better”.

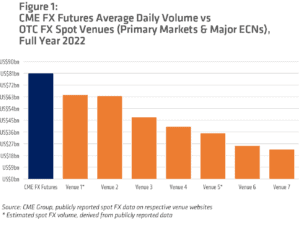

While there is clearly a role for both futures and OTC venues in liquidity provision, it is useful to place the CME FX futures market within the context of the leading OTC FX venues, using traded volume as a proxy for liquidity.

Figure 1 compares CME FX futures daily volume with spot FX volumes on the leading OTC venues – the primary markets plus major ECNs. This chart illustrates that although OTC volumes are higher than futures in aggregate, CME FX ranks as one of the top individual venues by volume across the whole FX landscape.

This is reinforced further by a recent BIS working paper, which found that “a growing number of market participants of all types now seem to consider currency futures traded on the CME as at least a close cousin of the primary [spot FX] CLOBs.” Furthermore, trading volume in CME FX futures “now often exceeds OTC FX spot trading volume in the primary market” leading some to argue that “FX futures do, in some cases, lead price discovery in FX spot.”

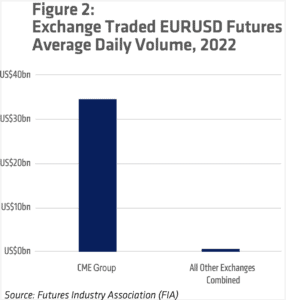

Having considered OTC markets, it is also instructive to place CME FX in the context of the exchange traded FX futures market. Figure 2 shows the average daily volume for exchange traded EUR/USD futures globally, highlighting that CME Group is the natural home for trading FX futures in major currency pairs.

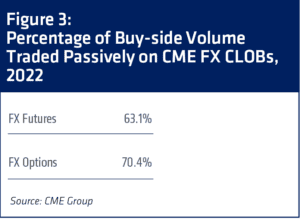

Liquidity means more than just volume though. Topics including reject rates, market impact, the ability to trade passively, and diversity of the trading ecosystem are also hugely important.

The majority of CME FX futures are traded on the central limit orderbook (CLOB). Pricing on the CLOB is firm, anonymous, credit agnostic and all-to-all, with a hugely diverse ecosystem of users.

This not only means there are zero reject rates, but also enables all participants to be liquidity providers and to trade passively within the orderbook – reducing transaction costs by avoiding paying away the bid/offer spread. For example, in 2022, 63.1% of hedge fund and asset manager volume was traded passively in FX futures, while for options the proportion was 70.4%.

While the CLOB is the central venue for futures liquidity, some customers want to trade risk-transfer OTC-style via disclosed bilateral negotiations with chosen liquidity providers. This trading style can be particularly important for larger sized trades and for more esoteric pairs that aren’t as actively quoted in the order book, where liquidity providers can lean on OTC liquidity.

During 2022, there was a sizeable upswing in customers trading CME FX products via these blocks (large risk transfer trades) and EFRPs (OTC vs futures spreads), with year-on-year growth of 196% in 2022. More than 20 liquidity providers now support these trade types at CME FX, including the majority of top-tier global banks as well as non-bank market making specialists.

“Many customers have long recognised the unique liquidity and clear benefits of using CME FX futures and options as a complement to their OTC activity,” said Paul Houston, global head of FX products at CME Group. “However, an increasing number of new participants, particularly from the hedge fund and asset manager community, are looking to access futures liquidity to solve margin and capital challenges.”

A closer look at MXN Futures – a growing market at CME Group

- In the first half of 2023, an average of $1.68B of MXN futures traded every day– an increase of 24% YoY.

- March 2023 was an all-time record volume month, with $2.84B trading daily.

- Over 4,700 unique users across 80 countries traded CME Group MXN futures in 2022.

To find out more on how and why traders are using CME FX products please contact FXteam@cmegroup.com

Exchange traded derivatives and cleared over-the-counter (OTC) derivatives are not suitable for all investors and involve the risk of loss. Exchange traded and OTC derivatives are leveraged instruments and because only a percentage of a contract’s value is required to trade, it is possible to lose more than the amount of money initially deposited. In France, each of CME, CBOT, NYMEX and COMEX have been recognized by the French Minister of Economy under Article D. 423-1 of the French Monetary and Financial Code. CME Group’s full disclaimer: https://www.cmegroup.com/disclaimer.html.