How have periodic auctions developed in Europe?

Cboe launched Europe’s first periodic auctions mechanism in 2015, ahead of the 2018 Mifid II regulations. There was industry demand for an alternative, low-impact execution mechanism given the restrictions Mifid II was placing on other trading channels.They now represent 6.5% of continuous trading, compared to 5.3% a year ago, with Cboe Europe holding a 78% market share in the category (as of August). Periodic auctions are functionally similar to the opening/closing auctions operated by European listings venues in terms of the price formation process and levels of transparency. But, by running auctions multiple times a second, they represent a near-continuous market model operating in parallel to the other truly-continuous market mechanisms.

What benefits do periodic auctions offer investors?

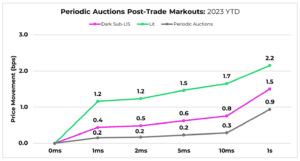

Periodic auctions are popular because they help investors source price/size improvement by prioritising order size over speed at the order allocation phase, being price-forming rather than price-referencing, and by introducing randomness in trade timing. Cboe’s periodic auctions can last anywhere up to 100ms, which is around 4,000 times slower than lit books. With pre-trade transparency only around equilibrium price and volume, the mechanism provides market participants with the necessary information to understand the potential liquidity available, without exposing imbalance information. These features result in periodic auction executions demonstrating a much more stable and symmetrical post-trade price-path than is common in continuous trading mechanisms (see Chart 1).

Chart 1: Europe periodic auctions absolute price change, Jan-July 2023 Market data from periodic auctions communicates the availability of liquidity and the opportunity to trade during each call phase – often at prices within the European best bid and offer (EBBO) spread and often in larger sizes than other venues. Although median trade sizes are similar to those observed in lit markets, there are significant opportunities to trade in larger sizes. Chart 2 shows that during H1 2023, 37% of value traded on Cboe’s periodic auctions was in larger sizes.

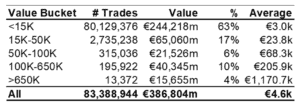

Market data from periodic auctions communicates the availability of liquidity and the opportunity to trade during each call phase – often at prices within the European best bid and offer (EBBO) spread and often in larger sizes than other venues. Although median trade sizes are similar to those observed in lit markets, there are significant opportunities to trade in larger sizes. Chart 2 shows that during H1 2023, 37% of value traded on Cboe’s periodic auctions was in larger sizes.

Chart 2: Cboe Europe periodic auctions trade sizes by value, H1 2023 How can you expand the use of periodic auctions further?

How can you expand the use of periodic auctions further?

We think the execution quality benefits of periodic auctions can be distributed more widely by expanding their use cases to additional phases of brokers’ smart order routers (SORs). In a simplified model, there are three phases of a broker’s SOR: Passive posting to capture the spread; spread crossing strategies to capture liquidity with urgency; and liquidity-seeking phases which search for midpoint liquidity that will not disturb the lit quote. Historically, most brokers have integrated periodic auctions into that passive and the liquidity seeking phases of their SORs. But there is substantial untapped liquidity which is off-mid, but still within the EBBO.

As a result, Cboe has begun introducing additional functionality to its periodic auctions to attract new sources of liquidity to the mechanism, including both spread-crossing and greater passive posting flows. These include an accept-or-cancel (AOC) order type, allowing brokers to test for liquidity in a periodic auction on their time sensitive, spread-crossing orders, a passive peg order type that enables liquidity provision and spread capture strategies, and a dark on expiry option that allows users of periodic auction orders to check for midpoint liquidity upon expiry of a periodic auction order. Our initial data indicates that up to 20% of spread-crossing orders could capture price improvement.

How will your new sweep order types ease access to Cboe periodic auctions?

Our most recent enhancement, implemented in July 2023, is a set of new “sweep” order types, which allow users to access our dark, periodic auction and lit order books via a single order. These order types offer an efficient solution for participants to benefit from price improvement in our periodic auction and midpoint books before targeting lit liquidity, thereby reducing market impact. They create new opportunities for those seeking to capture spread via passive order placement. Cboe’s existing dark to lit sweep has been in place for many years and is used nearly universally by participants to capture midpoint price improvement on orders destined to cross the spread in our lit books. The sweep order we have just released introduces similar capabilities in relation to our periodic auctions for the first time using the AOC order type – and we’re making it particularly easy to enable, and to customise features such as price-improvement and all-or-none settings for the periodic auction leg.

The use of these features allows firms to control the conditions under which an urgent order should be accepted into the periodic auction (with the associated randomness of timing) depending on the relative importance they attach to price-improvement, size-improvement or speed of execution. Additionally, the use of all-or-none as a default is expected to protect the providers of passive resting liquidity from negative mark-outs – since there is no unexecuted balance of the urgent order being routed into the lit markets. As more firms realise the benefits of periodic auctions and take advantage of these functionalities, the opportunities for price and size improvement will grow.