David Howson, president, Cboe Europe

Firstly, how have European equity markets reacted to COVID-19 and what lessons will the industry learn from this period?

The response from the industry to the situation has been extraordinary. The main lessons learned from this period are that Europe’s market infrastructure has proved extremely resilient, which is testament to the work of all participants. It has shown the benefits of the diverse eco-system that exists and that is something we must work hard to maintain – or enhance, where appropriate. The second lesson is that it is an opportunity for the industry to re-assess its working culture and make changes that could potentially improve mental wellbeing and diversity.

Coming in to the role as president at Cboe Europe, what did you regard as your key areas of focus?

A big focus for us so far this year has been enhancing our equities offering and advocacy around the review of MiFID II/MiFIR. We submitted robust responses to the consultations undertaken by the European Securities and Markets Authority (ESMA) and the European Commission, and have had some really positive meetings with regulators and legislators on this topic in recent months. We have emphasised our belief in the need for a healthy eco-system of complementary execution mechanisms to support a diverse range of trading strategies and different market conditions. With that in mind, we stressed to regulators the importance of retaining choice for investors when it comes to trading mechanisms – this includes all waivers and the systematic internaliser category.

The other major area of focus has been successfully closing our acquisition of EuroCCP, a leading pan-European equities clearing house. That is a really important strategic move for us, to enhance our equities offering and allow us to expand into European derivatives trading and clearing, which we are very excited about. We have been working very hard on that build-out and are on track to introduce a lit, pan-European equity derivatives market in early 2021, launching with futures and options on six key European equity indices.

You mentioned enhancing your core equities trading business, how is that shaping up this year and beyond?

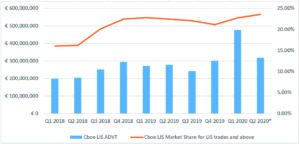

We feel we are in a really good place with our venue offering, with a range of carefully designed execution mechanisms to cater to every trading style and strategy. At one end of the spectrum, our lit books offer actionable liquidity and immediacy of execution, typically for smaller-sized orders. Our dark and periodic auction books, satisfy the need for low-impact orders with a degree of urgency. At the other end, Cboe LIS is an indication of interest and execution platform which caters for the more infrequent but highly-valued block-sized trades. We are now firmly established as the second-largest block platform by market share, and are often the largest platform on a daily basis. The most recent addition to our armoury has been a closing service, called Cboe Closing Cross (3C), which offers a low-cost alternative to primary closing auctions.

What was the motivation behind the launch of 3C and how does it differ from other initiatives attempting to bring competition to that area of the market?

We launched 3C in August 2019 in response to client demand for an alternative to primary market closing auctions, which effectively remain natural monopolies. There is no competition on trading or market data fees during closing sessions, issues which have been exacerbated by the growth in closing auction volume in recent years.

Our 3C model has a number of features that we believe make it compelling and distinguish it from rival services. It is a fully transparent order book, running four auctions every minute for a 25-minute period after the end of continuous trading. Participants can enter orders with an ‘at-limit’ price, meaning they will only trade at their specified price. This allows users to trade at the official closing price if they wish, but at any other price if there is contra interest. The service is also fee free until the end of this year.

We are cognisant of a limited appetite for competing, price-setting auctions and we do not want to distort the closing price formation process. Our service is really aimed at those institutions that want to trade large amounts of offsetting order flow at a specified price, but at a much lower transaction fee than those charged in other closing mechanisms. The beauty of the model is that it also allows users to trade around events that happen after the close, at a price away from the closing print. Given the volatile environment we’re experiencing at the moment, we think that feature is really important.

You have made a few enhancements to 3C in recent months. What are they and why have you made them?

We’ve made a few important enhancements to 3C as clients have begun to test the model and provide feedback. The price collar that exists on the service was widened on 15 May, from 5% to 20% of the last-traded price on Cboe’s continuous books. This is partly due to the fact that, given the increasing size of closing auctions, there is often a significant discrepancy between the closing print and the last-traded price in continuous trading. Furthermore, from 17 July, we are bringing forward the end of the continuous trading sessions for our Nordic, Dublin and Swiss market segments. This will ensure we are aligned with primary market timings in those countries, and means we will also bring 3C’s start time forward in those markets.

What else are you doing to help drive client engagement and improve your venue offerings for the rest of the year?

We are constantly getting feedback from clients on all of our platforms, and making enhancements that will drive activity and result in improved execution outcomes for end investors. We’ve been really focused on growing market share on our flagship CXE lit book, which is highly valued by our customer base as the major multilateral lit order book alternative to primary listing exchanges. We launched an additional liquidity provider scheme (A-LPS) for this order book on 1 May in Italian blue-chip stocks, and from 1 June in our French, Dutch, Belgium, Portuguese and Irish market segments. This scheme rewards participants with an additional rebate for setting the best bid or offer in pre-determined minimum sizes and above. It is open to any firm who meets the conditions of our standard liquidity provider scheme, and has already yielded really positive results. Our market quality including depth and spreads at the best bid or offer have improved in these segments, and we’ve seen increased market share, bringing benefits to all participants. Following these positive results, we will be looking to add additional geographies over the course of the year.