- Digital transformation journeys around market and reference data in buy-side firms are being hampered by the need for more cultural change.

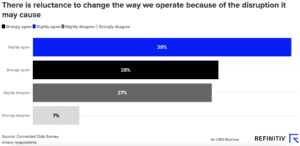

- Two-thirds of executives agreed that “there is reluctance to change the way we operate because of the disruption it may cause”.

- Five key themes emerged from buy-side firms as they look to the way they engage with market and reference data over the next 12 months.

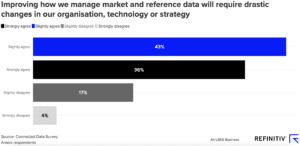

Even more shocking were the nearly eight out of ten buy-side executives who agreed with the statement that “improving how we manage market and reference data will require drastic changes in our organisation, technology or strategy”.

In the survey, the buy-side executives believed that current robust levels of investment in data and data management technology would continue over the next 12 months – 78 percent said their firm’s use of market and reference data will continue to increase over that period, and 65 percent said that the money spent purchasing this data will continue to grow. Almost six out of 10 also said the amount of money spent on managing market and reference data will continue to rise.

Nurturing cultural change

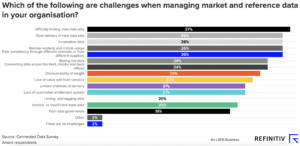

However, the buy-side say they are not just facing data and technology issues – they are facing cultural challenges, too.

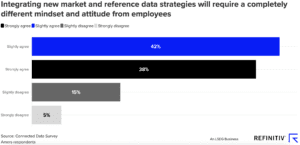

More than eight out of ten agreed that integrating new market and reference data strategies will require a completely different mindset and attitude from employees. For example, digital transformation programmes can often encounter resistance among teams that need to collaborate on data governance across boundaries such as the front office, middle office, and back office. Settling on data ownership and agreeing common data terminology can become particular flash points.

More than seven out of ten respondents agreed with the statement “There is a lack of understanding in my organisation as to how firms can most effectively leverage their spend on data”. Some firms are adopting fresh approaches such as creating a single golden source of market and reference data in the cloud, and then moving their analytics to the cloud as well.

Meanwhile, others are clearly struggling to identify and implement best practices that would boost the efficiency of data management and speed up the ability to access and use data. For two-thirds of executives, inertia is a substantial issue, as they agreed that “there is reluctance to change the way we operate because of the disruption it may cause”.

As is so often the case with change, the board and senior managers need to set the right “tone at the top” to support teams as they endure the discomfort of change. Senior leadership can also help teams keep their eyes on the prize, focussing on change that delivers greater efficiency or a boost in revenues. For example, clients who have moved to using Refinitiv Tick History in Google Cloud Platform – from an on-premises arrangement – have seen their total cost of ownership of tick history data decline by more than 90 percent.

Shaping market data strategyThe survey highlighted the fact that digital transformation is not just about technology and data – it is about people, too. Along similar lines, the Connected Data survey, brought to light several strong themes around the buy-side’s engagement with market and reference data.

While in many of these areas the buy-side is further ahead than the sell-side, the journey is far from over, and there is much work left for the buy-side to do. Bringing people along on the journey can help accelerate progress in key themes, which include:

- Cultural challenges impact data investment choices: Another cultural challenge – a difference in perceptions between the front office and the middle and back offices – has a direct impact on firms’ data and data management investment decisions.

- Buy-side focus on data governance priorities: One-quarter of buy-side firms consider their data governance programmes to be market leaders, compared with just 16 percent on the sell-side. Behind this is recognition of their firms’ key challenges and investment in technology.

- Accelerating regulatory change creates significant challenges: The survey data suggests that many buy-side firms have not developed sustainable ways to manage regulatory change.

- Firms push ahead on cloud adoption for key use cases: When it comes to the cloud, the buy-side is ahead of the sell-side in many areas, but firms need to make further progress in adopting the cloud for data storage and use.

- Operational resilience a priority for the buy-side: In this theme, too, the buy-side are ahead of the sell-side, and firms are continuing to invest in areas that strengthen operational resilience.

When it comes to digital transformation of market data strategies, buy-side firms have much they can be proud of, particularly when compared with their sell-side cousins. However, buy-side firms need to do much more to accelerate the necessary changes within their organisations, and many of these changes are concerned with altering the culture to better support evolution in both data and data management approaches.

This means baking cultural change into the digital transformation programmes that underpin the organisation’s market and reference data strategy. Done right, it’s clear that cultural change can create a real competitive advantage for buy-side firms, where data can directly deliver alpha.

Download the Connected Data Survey Report in full.