As block trading embeds itself deeper into buy-side workflows, understanding the nuances of dark liquidity is becoming critical. Alex Wicks, head of BlockCross sales and client coverage EMEA, Instinet explores how block volumes diverge from lit markets across seasons, weeks and hours – and why spotting these patterns matters for navigating EMEA liquidity. As block trading solutions become increasingly integrated into traders’ workflows, there is an increasing importance on utilising these tools in the most efficient way possible. Putting dark block liquidity under the spotlight reveals the liquidity patterns and variability which exists in this growing area of the market. Traders will be very familiar with the ebbs and flows of lit liquidity within EMEA, and the increasing focus on the closing auction. For this deep-dive into block liquidity we take a top-down approach, starting with annual seasonality, peeling back each layer to analyse the trends on a monthly, weekly and even hourly basis. The deeper we look, the greater the difference when you compare this to more traditional trading patterns.

As block trading solutions become increasingly integrated into traders’ workflows, there is an increasing importance on utilising these tools in the most efficient way possible. Putting dark block liquidity under the spotlight reveals the liquidity patterns and variability which exists in this growing area of the market. Traders will be very familiar with the ebbs and flows of lit liquidity within EMEA, and the increasing focus on the closing auction. For this deep-dive into block liquidity we take a top-down approach, starting with annual seasonality, peeling back each layer to analyse the trends on a monthly, weekly and even hourly basis. The deeper we look, the greater the difference when you compare this to more traditional trading patterns.

Starting with annual seasonality, the usual trends of bumper volumes during ‘earnings season’, ‘financial year end’ and other cyclical macroeconomic events seem to align across both block trading and algorithmic trading, boosting the liquidity available in the market. Traders might be surprised to hear that there are certain events within the calendar year that can close to double the liquidity present in lit venues but leave little to no boost in liquidity within the dark block trading ecosphere.

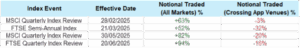

The most obvious and recurring example of this would be the quarterly ‘index rebalances’ flows, that traders heavily rely on as a liquidity event. When we analyse these key dates, for example the recent FTSE quarterly rebalance, the +94% uptick seen across all markets on the day is not mirrored in block trading, with crossing application venues reacting the opposite, witnessing a -16% decrease in trading volumes versus the month prior to the effective date*. This means that if you are sitting on illiquid orders on these key dates, you will need to be taking advantage of the increased lit volumes, or accept the likelihood that you might have to rest your order in darks across further consecutive days.

Variance in Trade Volumes for Major EMEA Index Rebalances 2025

Source: CBOE. (Notional Traded compares the notional traded on the effective date versus the month prior, expressed as a percentage)

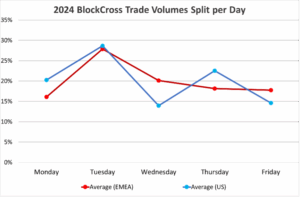

Block trading trends in EMEA become increasingly apparent when broken down into each session of the trading week. As you can see in the below graph, across the entirety of 2024 there was one date of the week that stood out for block trading – Tuesday. BlockCross on average traded 28% of its flow on a Tuesday, with the remainder of days between 15%-20% of their total flow. This Tuesday uptick versus Monday likely relates to the Americas time-difference, where EMEA PMs prefer to wait for the US dealers to digest the macroeconomic news of the weekend and then add to the available block liquidity.

Dealing a large block at the wrong price can significantly impact performance, therefore removing any weekend risk seems to be an attractive option when trading blocks throughout the week. This coupled with a bookended ‘work from home effect’, with Monday and Friday (on average) two of the lowest points on the graph, could also be drivers behind some of the volume variability.

Source: Instinet. (BlockCross application trades in EMEA securities in 2024, expressed as a percentage. Sorted by region of client domicile – EMEA, US)

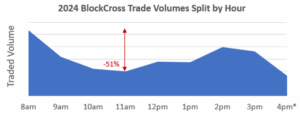

Now that we have identified the most bountiful days of the week to seek a block, it makes sense to look at the times of the day which are driving block volumes. The below graph looks at BlockCross trade volumes hour-by-hour (GMT) across the entirety of 2024. As you can see from the data, there is an initial spike in liquidity between 8am – 9am which tapers off as traders route orders onward and start to get filled on their illiquid orders. This tapering ceases between 11am – 12pm, starting to gradually climb once more, peaking between 2pm – 3pm. The time period 4pm – 4:30pm only covers half an hour, so this volume is not a true like-for-like comparison.

This block trading resurgence is caused by the fact that a significant number of asset managers don’t have regionalised trading, and the American-domiciled houses start to log-in and add new European liquidity into the mix from midday onwards. This surge lasts for three hours and continues into the afternoon session right up to the closing auction. This execution pattern has been witnessed consistently in the block trading space across a number of years and is a stark difference from the usual midday lull and final closing auction surge that can be witnessed in lit markets.

Source: Instinet. (BlockCross application trades in EMEA securities in 2024, bucketed by time)

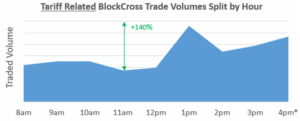

The only time whereby we have witnessed a deviation from these patterns is during the recent tariff-related volatility that has rocked global markets. Comparing days of the week has too much of a news-related bias, therefore the main focus was to look at how traders and portfolio managers changed their hourly block trading patterns in recent times of mass volatility.

We therefore analysed the first 2 weeks of April (Liberation Day was 2 April) to see how their block trading appetite had changed over this period. The immediate difference in the graph below was a reduction in the early hours crossing of blocks, and a considerable back-loading of liquidity into the overlapping market hours between EMEA and the Americas. This suggests that price uncertainty remained high before the US market opened, as traders wanted to steer clear of blocking at the wrong level before any potential market-moving news coming out of the US.

Source: Instinet. (BlockCross application trades in EMEA securities surrounding Liberation day April 2025, bucketed by time)

Looking ahead to the rest of the year, we will likely see a number of these similar ‘flash-points’ originating from the Americas, where block trading appetite pivots to the afternoon session.

*Crossing application venues include all Dark Pools which can be accessed via a crossing application.