Amid wider changes in macroeconomics given the war in Ukraine, the post-Covid recovery and rising interest rates, what are the impacts you are seeing in regard to block trading volumes?

The war in Ukraine has delivered unfortunate social and economic damage across the region and beyond, and together with inflation and the subsequent hiking of interest rates in the UK and elsewhere, this has caused European markets to recover from the pandemic at a slower pace relative to other regions. All three are large volatility events across differing but broad time horizons but the Covid pandemic outsized all other volatility events by a wide margin, as demonstrated by the S&P 500 VIX Index, trading at record highs in March 2020. In the chart below, you can see the FTSE (UKX) & EuroStoxx (SXXP) lagging behind the US Index (S&P).

Historical VIX Volatility in Comparison to Major Indices

Source: Bloomberg

While the positive correlation between volumes and volatility is often spoken about, when it comes to block volumes, we actually tend to see an inverse correlation. However, there has been an increased demand for our dark trading options, as well as, in the dark book within our BlockMatch MTF. Since our launch at the end of 2022, dark and RFQ volumes in BlockMatch EU have been exceeding our growth targets. Over the course of Q1 2023, BlockMatch dark market share increased by 57% and this past March, BlockMatch Europe and BlockMatch UK outperformed other European MTFs up 33% MoM combined, with our average block trade size moving +69% higher MoM as well.

Since European block venues are prioritised by size over time, it leaves investors preferring to maximise size to ensure they have the best queue position possible. As a result, we have seen an increase in demand from both the buy-side and sell-side in their conditional interaction with BlockMatch, by opting orders into Instinet BlockCross for the buy-side, or typically in the case of sell-side, DEA access to the venue. We give enormous credit to our team of technologists because we also see this as a testament to the sophisticated systems and scale they have built for us.

Market volumes show that European liquidity is becoming increasingly sparse and one-directional, which leaves investors competing against one another for the same limited liquidity. In the end, whatever the prevailing market conditions may be, our clients rightly expect innovation and a close partnership approach to assist with liquidity discovery.

How does trading in the dark affect impact in the lit and vice versa?

The concept of dark trading is to effectively enter or exit sometimes large positions, with little to no market impact. Over time, the number of dark venues in Europe has increased at the same pace that algorithms have become more advanced at reading signals, meaning that generally the trading footprint has become slightly more visible across many dark pools. Our role as a global agency broker, aligns perfectly with maintaining BlockMatch as a highly regarded dark venue, ensuring that all flow present in the pool, is client driven.

Regulation has also had an impact on dark trading. With the removal of double volume caps for UK stocks, dark trading has grown at a faster rate in the UK than mainland Europe securities, which lag behind as shown in the chart below.

Europe & UK Dark Market Share

Source: big xyt

Instinet also has a tailored and proactive execution consultancy relationship with clients. Trading in the dark is easy in itself, but trading in the dark at the right time is harder to manage. To this end, we apply various mechanisms to ensure the best possible outcome for clients and are always glad to guide with a robust quantitative approach.

There are multiple types of platforms available for block trading, (dark books, RFQ, SI, quote driven, and auction MTF). How do you clarify their roles?

The liquidity challenge, has for decades, been driven by a mixture of macroeconomic factors and regulatory reforms that have in turn accelerated the innovation and creation of various liquidity solutions designed to help investors, however the result has been an increasingly fragmented marketplace. This has evolved in parallel with new opportunities and growth within Block liquidity, especially hard-to-find mid and small cap securities, and other non-addressable liquidity; interaction with retail liquidity is also increasingly a focus for many.

Ultimately, the choice of how to trade depends on a client’s specific objective. For a buy-side firm, the trading options are not limited to traditional multilateral venues like dark pools operating within central limit order books (CLOBs). Bilateral protocols such as SIs and requests-for-quote (RFQs), as well as the use of conditional trading via indications of interest (IOIs), are now at the forefront of the block trading marketplace.

The chart below offers a clear and simple way to view the main differences between the types of platforms that are available.

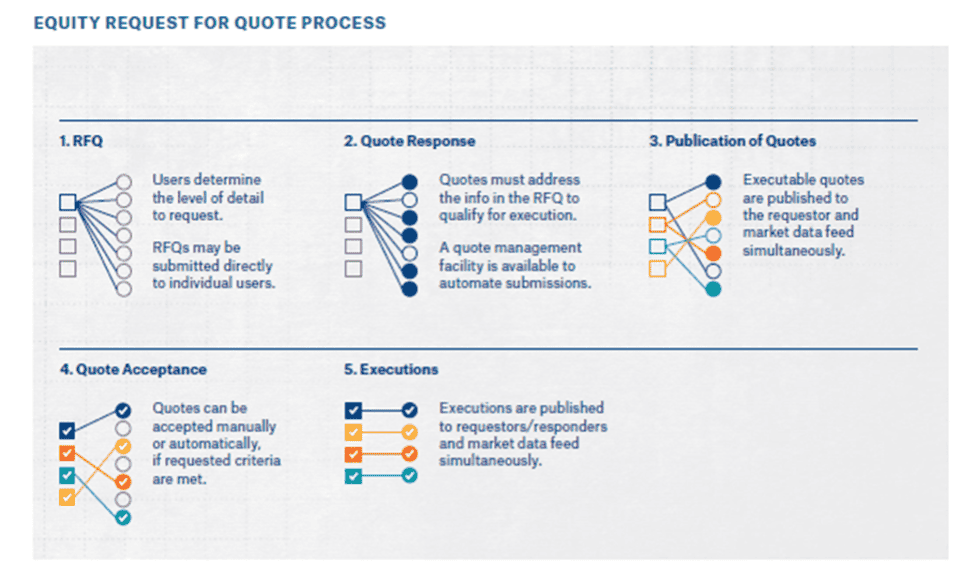

As a hybrid-venue, Instinet BlockMatch is designed to be conducive to natural block-sized liquidity and user control, providing the option to advertise willingness to trade through IOIs and RFQs. Users can send RFQs or respond with quotes and can use limit prices, bid, offer, or midpoint pegs. Control remains with the order originator regarding which counterparties to include. They can also elect to automate the RFQ process by way of a smart order router (SOR) or custom algorithm.

Here is a look at how the RFQ process works.

Instinet recently introduced expansions to its BlockMatch venue, tell us more about that and any plans to grow further.

Sourcing and aggregating different types of liquidity, while minimising the risks of information leakage, is our fundamental role as a broker, and the key to better and more consistent execution quality for our clients. That’s been the driver in launching BlockMatch in multiple regions around the world.

The fully regulated venues that we have established to date are; BlockMatch Europe, BlockMatch UK, and BlockMatch Asia. We have carefully engineered each one to support clients with the objectives, strategies, order types and nuances of their respective markets. BlockMatch Europe is our newest addition offering access to dark and displayed liquidity in pan-European equities. Additionally, BlockMatch offers IOI functionality which allows users to advertise and interact with conditional orders within the MTF. Clients are finding more and more value in our unique functionality, combined with the ability to seek out natural block liquidity.

In March of this year, our BlockMatch Asia venue expanded securities coverage within our dark pool in Hong Kong to include securities from Indonesia, Malaysia and Philippines. We plan on expanding securities coverage even further to other APAC markets in the near future. Since markets in APAC can have higher frictional costs of trading, wider spreads at BBO, and higher market impact in comparison to other regions, dark mechanisms especially can provide impact cost savings and spread savings there.

When we first launched BlockMatch Asia with Hong Kong securities in February 2022, one of the main features was the addition of a conditional book for the submission and management of conditional orders, There has definitely been an increase in client interest and awareness of conditional order types in APAC, over the past two years in particular, and we think that trajectory will only continue.

In addition to expanding BlockMatch Asia’s securities coverage, we launched BlockCross in Asia at the same time. BlockCross is our conditional order management platform that helps clients manage their large-in-size orders in a controlled environment. The launch there follows on the success we’ve had with BlockCross in the US and the growth trajectory that’s underway for the platform in Canada and Europe.

With greater fragmentation across European markets and methods of trading, and as continuous liquidity becomes harder to uncover, how do you think client needs are evolving?

There’s definitely a need for brokers to be omnipresent across all venues, while maintaining a level of “quality control” to ensure that clients are capturing the optimal level of dark liquidity, whilst minimising signaling to the broader market. Instinet’s algorithm platform offers multiple levels of “style” which can control near/far touch positioning and more importantly venue selection.

In the last year, Instinet’s dark allocations have seen a shift from our most commonly adopted “aggressive” style into our “normal” style, arguably in part as a response to declining market liquidity which sees a more concise venue selection. This shift has been driven by both our clients and research by our quantitative strategy team. Following this shift, our clients have seen a similar dark participation rate, but most importantly an improvement in performance versus an unadjusted arrival benchmark.

Normal vs Aggressive Volumes

Additionally, we see some of our clients asking for more control and have responded in a number of ways. Firstly, our BlockMatch RFQ venue allows for a counterparty selection filter, which enables a client to specifically target a particular type of liquidity as they look to execute (i.e retail, professional or market maker). Secondly, the global release of our BlockCross application provides clients with the ability to selectively “opt-in” individual orders into our BlockMatch dark book , giving the control back to the trader meaning that when a live opportunity arises, they can react real-time to block opportunities. BlockCross has been live for over three years in Europe now, and over that time the client base has grown to more than 120 buy-side clients, with more to come.

Another major need we find clients looking to satisfy, is better clarity and quality of analytical data, so that they can make more informed decisions throughout the lifecycle of their orders . What we are seeing through our interactions with our clients, is that the demand for data remains high with advanced analytical tools now considered essential for modern trading desks. Traders require a really clear picture of the marketplace, which means having the best real time analytics and data to generate actionable insights and make decisions. Further, in regard to our Instinet Newport EMS, we also see a greater demand for embedded analytics and hosted solutions. As a global agency broker and technology provider, Instinet is in a unique position to assist clients because we deliver bespoke, customised technology and high quality execution, a combination which allows us to be close to our clients’ needs, while also maintaining a high quality of data and output.