How have you seen algo usage evolve in recent years?

Rodriguez: We have seen the rate of change in the landscape moving at a faster pace than ever, not just from the product perspective but overall, and getting more complex. Considering UK versus EU venues, there is a diversification of venues, but within that, there are also variations in how people engage and interact. When there are two different brokers trying to access the same opportunity, those brokers will choose different methods to get it. The challenge is ensuring that you have the best and latest kit to be able to access the liquidity and succeed. Two of the most important factors in achieving that are broad and efficient access to liquidity, while also having the highest quality of execution. The current market backdrop is challenging in EMEA and exchanges are continuously trying to reinvent themselves with new order types and functionality to try and gain market share. So, we engage with them regularly and they let us know how we can calibrate our interactions to potentially achieve better outcomes.

That said, algo usage is evolving and clients have become much more involved in understanding their order performance. So, our discussions with clients have become increasingly focused on how we understand their particular workflow, their bespoke universe, and what they want to achieve. Clients can access execution consultants and quants on the trading desks at the bigger houses for assistance with various selection tools and methodologies but we also think it’s important that they measure, evaluate, and re-calibrate their engagement with brokers around the information they receive.

Laturkar: We see a similar progression in the Americas. Demand is indeed evolving faster than ever, with a steady shift towards electronic execution for the majority of our client base. Over the past several years, we have seen an increase in the level and sophistication of engagement here from our clients on broker algos, their behaviour and performance across multiple types of workflows. And while this is certainly true of our larger clients, we are also seeing increasing adoption across the broader swath of our client base. Algos are being leveraged more as execution focused performance tools, rather than just workflow tools and requirements differ across clients and client types. Trading objectives, workflows, intraday alpha expectations all vary quite widely, so it’s important for us to be able to engineer tailored solutions.

What changes do you see in regard to the average trade size of orders being executed with algorithms?

Rodriguez: Well, because no two clients have the same average order size and what might work for one client, might not work for another, it goes back to why we think having a more bilateral and bespoke approach to algos works best. In addition to the size aspect, there are a wider set of order flow and order types being executed with algos now as well that have to be considered.

Laturkar: There is certainly a wide variety of order behaviours and sizes coming through algos today. In the past, clients would only send smaller “easier” order flow through, but as algo platforms have matured and traders have gained an increased level of comfort, they are coming to rely on them for a broader set of workflows now. So, we do observe clients utilizing them as a key component in achieving effective liquidity capture on their larger orders too, while limiting market impact. On this point, I’d end by saying it is really not just about the changes in order size because it is also true of several other order flow characteristics including intention, alpha horizon, and order type.

Is customisation the be all and end all?

Rodriguez: Some client engagement is very specific in terms of what a particular client expects of us and our product. In a best execution environment, brokers are evaluated on performance and having the flexibility to customise when required is very important, this relies on close collaboration with clients. The ongoing challenge of maintaining a product that remains competitive is just as important as having something that you can fine tune as you see fit with speed. There is no point saying I can re-calibrate certain behaviours or parameters but that it will take me nine months’ work and effort to deliver it.

Certainly, from a European perspective, we also need to maintain orderly markets and ensure that we are adhering to regulatory expectations. So, as we customise, the level of knowledge that individuals are required to have today versus 10 years ago in that regard, is fundamentally very different. As an electronic house, we are also looking at products more holistically around how we can offer improvement across the stack as opposed to just individual components in silos. The micro data sequence is essential when bringing in that state-of-the-art machine learning component to what we’re doing.

Laturkar: It all depends on how we define customisation, of course – we have certainly seen an evolution in this area. At one point, we were building highly prescriptive customised algos for large firms based on very specific, mostly heuristic-based, instructions. Most of these were meant as replacements for workflow or trader behaviour. We are not seeing as many of these requests from clients today. From our perspective, we also found a proliferation of those highly bespoke strategies made it harder to maintain their code, measure their performance, or apply learnings to and or from the broader platform to those custom algos.

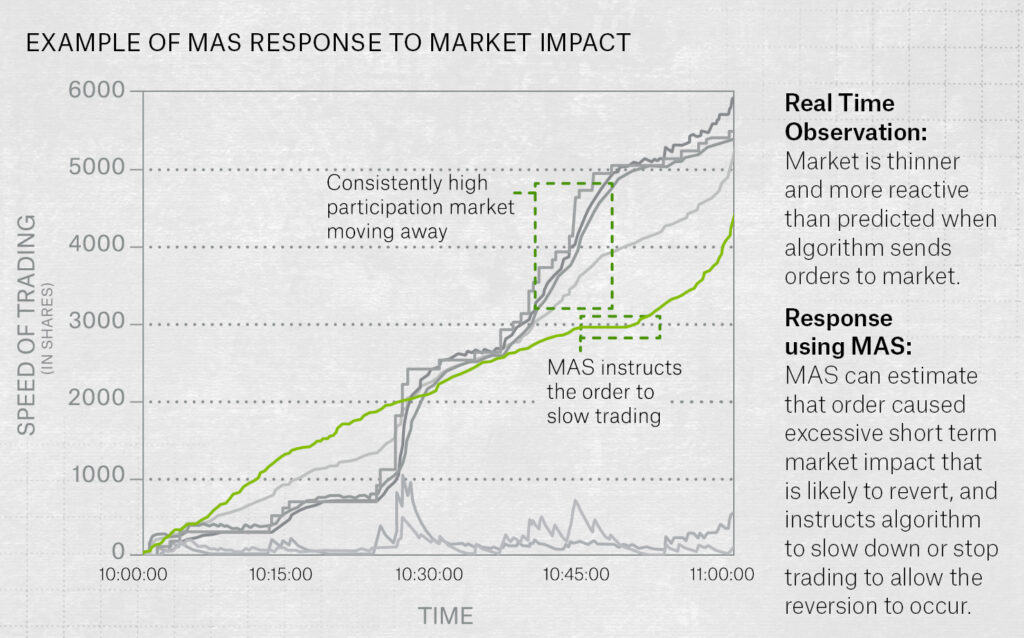

Currently, while we still have tremendous client interaction and engagement, there is a different focus. Clients have a desire to use what the broker algos have to offer, which allows for pushing the envelope on improvements in execution quality, which also involves collaborating on customisations for their specific type of flow. So, we find the key is intelligently using what we have and working closely with our clients to adjust and cater to the unique requirements or characteristics of their trades. It follows that we would want to have a platform that allows us to be efficient, nimble, and responsive to client specific customisation, and this led us to the launch of our Micro Adaptive Sequencer (MAS). You can think of it as a dynamically updated optimisation platform that allows for embedding multiple models, inputs and factors to inform execution profiles. With machine learning capabilities and dynamic optimisation built in, MAS is a model that also runs on a real-time basis.

It sits on top of multiple tactics and determines key inputs like scheduling, profiles, and aggressiveness by utilising multiple factors – which allows for these to be variable from client to client. This is a framework we’ve built to not only effect performance improvements, but also to support responsiveness to client-specific objectives and flows. With MAS, we can organically include historical observations and real-time overlays, using machine learning based models to combine the inputs into a cohesive instruction to the underlying algorithm for clients.

What other innovations is Instinet working on?

Rodriguez: As a neutral agency broker, every innovation we make is about helping our clients perform better. Because we don’t trade our own book, every order we generate and each of the capabilities we develop, are for the sole benefit of our clients. Our MAS innovation is a very key part of that while we also focus continuously on offering new markets, new functionality, and the ability to deliver seamless and quick solutions.

With regard to new markets, we actually just became the first non-member international broker to smart order route in South Africa across Johannesburg Stock Exchange (JSE) and A2X. As a complementary alternative to the primary exchange, A2X is playing an integral part in the progression of South Africa’s marketplace, providing market participants with an efficient and cost-effective trading venue to post-secondary listings and trade shares. We arranged the Instinet connection to A2X through our local executing brokers and we’re quite excited to have access to this venue for clients. There has been a strong uptake in A2X among industry participants, as seen by the growth in listings and market share.

Source: A2X

At the end of the day, trading venues and liquidity sources are of the most value when they are carefully chosen and engaged based on each order’s particular characteristics, market conditions, and the trader’s objectives. It’s important not to think categorically, such as “should I interact with venue X?”, but rather to develop a continually evolving strategy for “when and how to optimally interact with venue X”.

Globally, the concentration of volume around the close is yet another area demanding a set of specialised tools. Emphasising this trend, global volume on the close rose again almost 2% in September, with an increase in every region.

Source: Instinet, MSCI

In Developed Europe, the September surge resulted in a record high proportional volume on the close.

Source: Instinet, MSCI

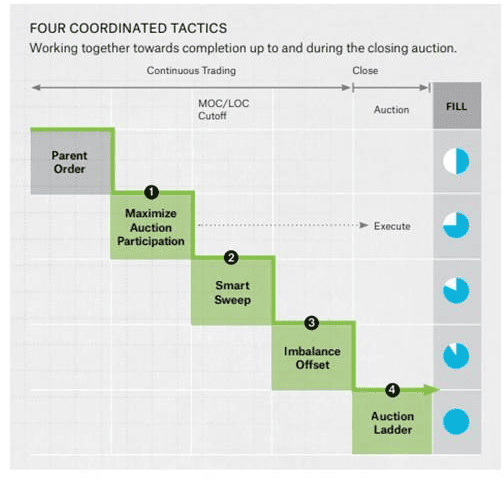

Laturkar: Referring to Sal’s point about making sure clients have optimal tools designed for the close, our quantitative teams conducted extensive research and analysis on the dynamics of exchange closing auctions, examining their impact on liquidity and market movements. As a result, we engineered a set of precise Close Overlay micro tactics to address the ongoing volume trend and the opportunities that presents. They aid performance because they allow you to trade opportunistically in various ways, as the close approaches and we designed them in such a way that they can be set to work one after the other to complete unfilled orders, irrespective of the specific algo or strategy in use.

Longer-term, Instinet continues to invest across the entire algo stack. Last October, we acquired FIS execution systems along with their robust signal and routing technology, which we are in the process of integrating within the overall platform. As well, there has been a large amount of investment at Instinet to significantly upgrade our market data and market access technology which are, of course, both critical components in achieving optimal execution for our clients.

Do you foresee a consolidation of algo providers?

Rodriguez: We have seen a lot of M&A recently in the market. The thing to remember is that flow is allocated on performance – clients are quick to find out who is good and who is not. This will lead to more consolidation amongst fewer algo providers. You need to continually invest to remain relevant. If some providers are underinvested that flow will move elsewhere. The more flow you get the more benefits you get from a cross perspective. Incumbent firms like us on the brokerage side need to make sure that we not only get as much business with our clients but also do as much business with the relevant venues. We’ve seen an increase in conversations with some houses around outsourcing for those that have perhaps under invested or those that are seeing the rising cost of being in this business. We’ve been a beneficiary of those situations.

Laturkar: I would say we are already seeing some level of consolidation occurring across the broker landscape. Part of it is driven by the points made earlier, regarding increasing levels of bilateral engagement between clients and brokers. In order to sustain a meaningful level of engagement, clients have had to focus on deepening relationships with key counterparties. On the flip side, however, given the focus is on execution performance, that allows for continuous innovation and there is increasing competition among new entrants in this space. We are always welcoming of more solutions for the industry.