Figure 1 – Closing auctions as % of total on-book liquidity. Source: Cboe Global Markets

Closing auction growth

Over the past five years, the closing auction has become the most significant liquidity event in European equities, with over 25% of daily volumes being executed during the last 5-10 minutes of the trading day. The growth in volumes traded at the close cannot be attributed to a single factor, rather it is a product of multiple drivers including; (i) growth in index-based investment strategies and products, (ii) increased systematic trading during the closing auction period, and (iii) an increase in the utilisation of participation algorithms as an execution tool.

However, with the growth of closing auction liquidity, there are increased incentives for industry players to compete for a share of that business. In many cases, competition leading to a reasonable level of fragmentation can result in positive outcomes for investors – as evidenced by fragmentation of continuous trading with MiFID I. However, it is not clear that fragmentation will drive similar positive outcomes if it is applied to the closing auction given that this event is a truncated, high volume trading session with price discovery concentrated over a few short minutes ahead of a single uncross.

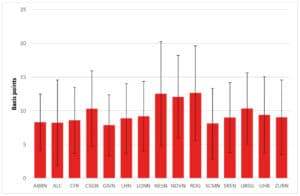

Figure 2 – Price dislocation in selected Swiss Blue Chips (2019): impact of removing 10% of closing auction bid/ask liquidity by stock (+/- 1 standard deviation). Source: Internal database

Price dislocation in the closing auction

Therefore, to investigate this topic closer we partnered with the University of St. Gallen to analyse the ramifications of fragmenting liquidity away from a single closing event. University team led by Prof. Dr. Karl. Frauendorfer focused on two main impacts of closing auction fragmentation – price dislocation and price discovery.

The research finds that a removal of liquidity from the closing auction results in a shift in the closing auction price. From a methodological perspective, only the removal of liquidity eligible to participate in the closing auction uncross was considered in this analysis (i.e. orders priced away from the uncrossing price, and therefore not included the executed volume, were disregarded). As such, as this removal of liquidity is quantified on Figure 2 where we see that a removal of 10% of the bid or ask liquidity dislocates the closing auction price between 8 and 12 bps across Blue Chip stocks. In addition, we can observe that price dislocation increases monotonically and almost linearly with the liquidity removal.

Price discovery in the closing auction

Furthermore, we find that in the call phase of the auction, participants are reacting to orders arriving in the book. This trend can be demonstrated by measuring the Weighted Price Discovery Contribution (WPDC) throughout the closing auction period.

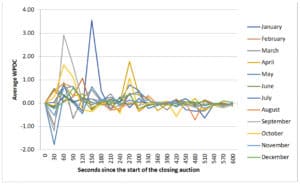

Figure 3 – Price discovery in Swiss Blue Chips (2019): average WPDC per 30-second interval. Source: Internal database

Figure 3 measures the WPDC during the closing auction in 30 second time buckets. The evolution of WPDC and the associated spikes, especially in the first half of the auction phase, illustrates that trading participants are reactive to incoming liquidity in the call phase. Therefore, fragmentation of closing auction liquidity would results in a dilution of closing order interaction and a subsequent weakening of price discovery.

Final remarks

The closing auction is an increasingly significant daily liquidity event that establishes an essential industry performance and valuation benchmark – the official closing price. As such, fragmentation of closing auction liquidity is likely to have more significant consequences than fragmentation of liquidity during continuous trading. Exploring the ramifications of this, our research indicates that removing as little as 10% of the liquidity from the closing auction results in significant price dislocations of over 8 bps. A key driver of this dislocation is the dilution of order book interactions during the call phase, with less reactivity to changes in the shape of the auction order book acting as an impediment to efficient price discovery.