Cboe Europe has made big gains in its market share over the last two years – enjoying particular success in its lit orderbooks, which have grown from 15% of all lit trading in January 2021 to 28.1% in March 2023. But more interesting than these market share gains are the recent inflection points in market quality, where for the first time, Cboe’s orderbooks now lead those of the primary exchanges on key indicators.

Lit orderbook functionality is fairly commoditised across venues, so what has driven the evolution in Cboe’s favour? Our execution consulting team is responsible for understanding those drivers and demonstrating to clients how changes to their own venue-selection behaviour can enhance their trading outcomes.

The first challenge is to understand what outcomes clients value – especially because preferences vary by client type. For example, a broker executing customer flow is keen to achieve the best prices, but must also execute orders according to their customers’ instructions (e.g. be at least 5% of the volume). Hence they optimise their behaviour to achieve the best overall result, balancing execution quality and certainty. By contrast, discretionary traders are less constrained, and typically want to add risk exposure only when they are confident of being able to unwind the position profitably. Therefore, when adding risk, they trade very passively, prioritising execution quality above execution certainty.

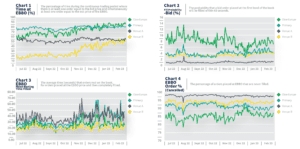

Armed with that context, let’s look at some microstructure dynamics that have underpinned Cboe’s growth. Charts 1 through 4 reflect Cboe’s progress against key microstructure metrics for top French securities from July 2022 to February 2023, comparing Cboe to the primary exchange and two other venues.

Source: BMLL Technologies

Chart 1 shows the proportion of time during which each venue displays both the European Best Bid and Best Offer (EBBO), something often referred to as “EBBO Presence”. A venue with higher EBBO Presence (as opposed to one which sets the EBBO often, but sees quotes quickly cancelled) signals it has a healthy and diverse range of participants and will attract more aggressive flow from brokers seeking the best price. The chart shows that Cboe recently displaced the primary exchange in terms of its EBBO presence in FR40 stocks, being present at the EBBO over 80% of the time. Why has this happened? A key factor is Cboe Europe’s increasing attractiveness for resting orders.

Unless under time pressure, brokers often seek to execute passively, to capture the spread rather than pay it, provided prices don’t move adversely in the meantime. Hence when trading passively, key factors in venue selection include minimising information leakage (e.g. by using midpoint venues or periodic auctions) and, where using a lit orderbook, choosing the one(s) that promise the highest speed and certainty of execution. So, when submitting a bid or offer to a lit book, then the quicker a venue fills that order, the better. And Cboe outperforms in this area.

On the FR40 index, passive orders placed at the first level of the book on Cboe are more likely to be filled within 60 seconds than those posted on any other venue (Chart 2). This result is also reflected in the EBBO mean resting time (Chart 3), where Cboe has a growing advantage in execution speed as a result of a deterioration in the time to fill on the primary, which now has an average resting time for fully filled orders that is now more than 1.5x higher than on Cboe.

Turning to liquidity-taking (aggressive) behaviour: Whilst Cboe Europe is exclusively at the EBBO more often than the primary exchange, there is typically more than one venue present. When brokers crossing the spread have a choice of venues tied at the EBB/EBO, execution certainty becomes a key differentiator. But again, passive orders hold the key: the relative stability of Cboe’s EBBO vs. the primary, (as evidenced in a substantially lower order-cancellation rate reflected in Chart 4), increases the certainty that clients can successfully execute their aggressive orders on Cboe – creating a positive feedback loop, where more aggressive flow further accelerates fill-probability and reduces time-to-fill for passive orders. High quality liquidity begets high quality liquidity.

And what about the comparative “quality” of passive executions on Cboe’s lit orderbooks? Truthfully, venue operators are not best placed to judge execution quality, especially so for customer order flow – we lack the context of the parent-level objectives to understand the quality/certainty trade-off a broker is making. But we believe that our growing outperformance across all of these microstructure metrics point to a healthy and diverse ecosystem – and even more importantly, our customers tell us we’re doing fine.

While these charts reflect activity in French stocks, we’ve seen a similar trend in all large-cap and mid-cap indices across Europe. Cboe is increasingly at the centre of price formation for European equities.