ITG STUDY

It is difficult to attribute information leakage to a single venue because most modern routers, ITG’s included, create routes to many venues proximate to any price move. Since it is possible to have information leakage without a fill—the most obvious example being lit quotes on exchange—any of the venues used before a price move could have been the cause.

Randomized controlled trial

We built a feature into our dark router to disable a random dark pool for the first 30 seconds of a parent order 70% of the time. This creates a control group (30% of orders are unchanged) and several test groups, one for each dark pool we access. The study selects only orders that are large enough to be eligible to trade to every dark pool we route to.

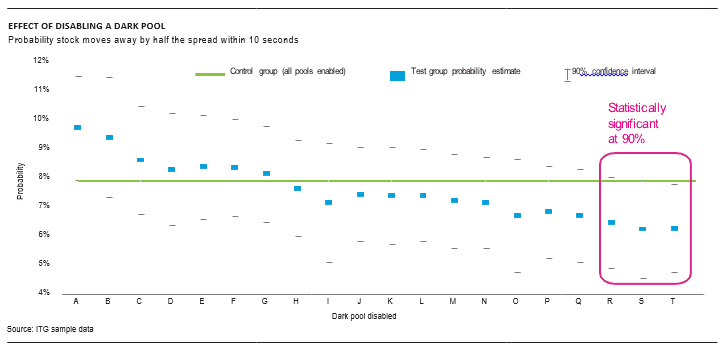

Using the data from our randomized controlled trial, we created a logistical model to estimate the probability that the price would move away from the parent order arrival midpoint price by more than one-half of the spread in the first 10 seconds of the order. After fitting the model, we compare the probability of the control group with that of each test group and look for statistically significant differences. The results are below.

Recall that the lack of a dark pool defines a test group. This means the Dark Pool T group represents the probability of the price moving away from the order when Dark Pool T is disabled. It may seem counterintuitive, but because this group has a statistically significantly lower probability to move away than the control group, you can conclude that Dark Pool T exhibits information leakage. There are three such dark pools: R, S and T. Each has statistically significant information leakage, according to our method.

Contrasting with adverse selection data

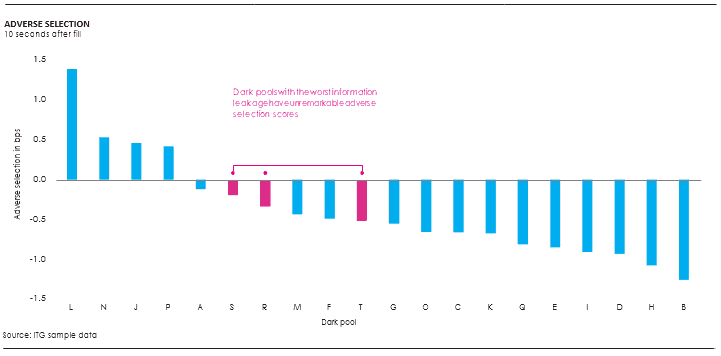

One downside of our approach is that it requires a great many parent orders and sophisticated modelling to calculate. This is not the case for adverse selection, which is measured at the child fill level and converges quickly. It would be nice if the two approaches gave consistent results, but they do not. This isn’t to say that you can’t have both adverse selection and information leakage, but they are fundamentally different and do not seem to be directly correlated, as shown in the Adverse Selection chart below.

The dark pools represented by magenta are the same three—R, S and T—with statistically significant information leakage. Note that these information-leaking dark pools have unremarkable adverse selection scores. This isn’t too surprising considering the earlier discussion of adverse selection: You are rewarded for executions that precede an unfavorable price move. This makes sense if the fills and the price movement are not correlated, but in the presence of information leakage, this assumption does not hold.

CONCLUSION

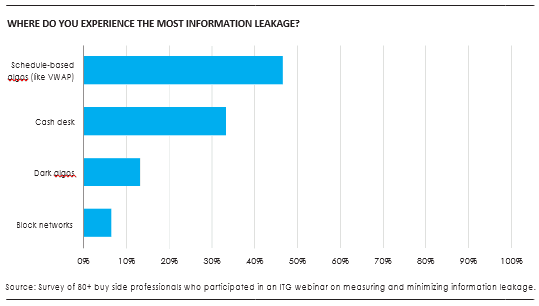

Information leakage can result in significant underperformance for large orders. In general, dark pools reduce information leakage relative to alternatives such as high-touch traders, block positioning and exchange trading. Our survey results on Page 5 show a similar point of view from the buy side, with dark algos and block networks getting the fewest responses to the question about where traders experience the most information leakage.

Still, it is important to be rigorous about dark pool trading because so much is at stake for many of the orders we see in this type of algorithm. Fragmentation creates a large surface area for problems. Trading in 20+ dark pools means that we rely on many firms to get everything right in terms of matching engine design, organizational controls and technology to avoid information leakage. It’s not surprising that we see a small number of pools that don’t meet our standards.

We think randomized controlled trials are an important tool for measuring complex strategies. This type of analysis allows us to find more meaningful relationships between tactical choices and parent order performance. In some cases, such as venue-based adverse selection analysis, the results of a tactical study can even conflict with the results at the parent order due to bias or second order effects. We plan to continue running this experiment and others like it to rigorously search for improvement in our own strategies and how we interact with our counterparties.