Although the COVID-19 pandemic has dominated the news agenda in recent months, there have been other events that have affected the geopolitical landscape.

The simmering trade tensions between the major global economies, the Australian bushfires, and the crisis in the oil market have all added to market jitters across the world.

Volatile FX markets

For FX markets, the uncertainty has led to volatility that has not been seen since the vote on Brexit.

However, this time round, volatility was not limited to market movements across G10 and Emerging Markets countries. Volatility also extended to the physical act of work — where we work from, and how we work — as many in the trading community found themselves working outside of their usual office environments.

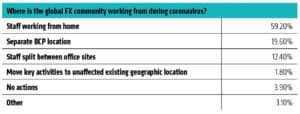

Where is the global FX community working from during coronavirus?

The preference of the majority of clients is to focus on providing their employees with the flexibility and support to work from home. Not within living memory have continuity planning measures been put in place on this scale across the FX trading buy-side and sell-side.

Supporting FX markets

At Refinitiv, we have ensured that we continue to support the market appropriately, no matter what the circumstances are. Across the world, our colleagues have been able to resolve client challenges within hours of them arising. And have done so while sitting on sofas, kitchen chairs, or deckchairs in their homes.

Access to liquidity

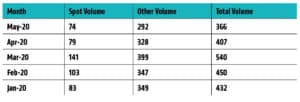

So far this year, the average daily volume across Refinitiv’s FX trading platform is around US$460bn, which is among the highest volumes facilitated by a single FX trading service worldwide.

Considering the disruptive circumstances in which these volumes are being reached – and how our clients were able to find continued access to liquidity across the currency pairs and geographical regions needed — is testament to how effectively our partners were able to transition to virtual work environments.

Record FX trading volumes in March 2020

The total average daily volume (ADV) of foreign exchange trading across Refinitiv platforms in March 2020 totalled $540bn, the highest ADV recorded since Refinitiv began publishing.

Refinitiv’s network of clients, including almost every single major institutional FX trading firm, is connected to more than 2,300 institutional clients and nearly 200 liquidity providers through Refinitiv FXall.

FXall’s advanced workflow solutions and execution tools have been critical in helping the buy-side safely cope with much larger volumes from their remote or virtual work environments. FXall clients rely daily on a broad range of features, including:

- Pre-trade order netting (including cross-currency netting and netting of same pair exposures that have different dealt currencies) to submit orders to the market for the most cost-effective execution possible.

- Batch trading workflow and rules-based auto-execution, in order to automate all or portions of clients’ trading activity and increase operational efficiency.

- Execution algorithms and other advanced order types that help users access liquidity in smarter ways, minimising market impact as well as information leakage.

Similarly, via Refinitiv FX Matching, we are well established across more than 900 client sites and over 5,000 manual Refinitiv FX Trading users, making us the single largest ecosystem for FX transaction venues across the markets.

Business continuity support

Very early on during the disruption, we reached out to over 500 of our leading clients across the buy-side and sell-side. We wanted to understand how they are adapting to their virtual environments and the areas in which they might need help and support.

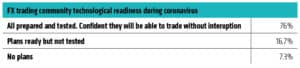

FX trading community technological readiness during coronavirus

The insights gave us a fair representation of why the electronic trading venues that we provide are the essential cogs in keeping the FX global ecosystem up and running.

This was a test of our support, infrastructure and continuity services as well. But it is highly encouraging to see the way in which the entire industry managed with this fast and sudden change. It is quite remarkable.

Market insights and compliance

With Refinitiv FXall Trade Performance Analytics, we have enhanced how buy-side clients can monitor market spreads, and build greater insights to help focus on transaction cost analysis (TCA) — an essential consideration during this disruption.

Access to liquidity and counterparties for our clients was an important consideration, but a further critical element of our strategy was to provide quick and easy access to the trends, market insights, and tools they required to ensure regulatory compliance.

The launch of Refinitiv Compliance Archive in partnership with Global Relay has helped ensure that we can provide archiving and compliance support for all ‘virtual engagements’ our clients undertake.

As part of our FX strategy, we are building towards transforming the FX ecosystem of solutions we offer to the industry. And as market leaders in forex trading; we are building towards a more efficient and transparent future for all market participants.

To see the full research, click here.