Some 15 months on from the implementation date and go-live for the new MiFID II environment and a year on from the introduction of the first set of double volume caps (DVCs), the question remains where are we now?

There’s been much debate around whether the overall liquidity landscape has changed for the better since MiFID II’s implementation, or if it has become more challenging to navigate. Following the removal of the Broker Crossing Network (BCN) construct and with dark MTF trading activity in Europe decreasing significantly since January 2018, focus and attention of resource has been directed at understanding how best to source liquidity opportunities to get business done.

A workflow shift in routing more orders towards Large in Scale (LIS) venues has resulted in the proportion of dark activity which can be considered “blocks” as defined by the ESMA to increase to over 30%.

A systematic change?

The much-anticipated Systematic Internaliser (SI) regime, whilst originally a product of MiFID, came into play more meaningfully for equities under MiFID II and continues to command much attention as electronic market makers develop and refine their bi-lateral, transparent liquidity provision. In Q1 2019, traded volume by the largest six electronic liquidity providers reached just over €1.5bn per day, according to a Rosenblatt report. Taking into account addressable SI liquidity only, this can be considered in the region of 10% of total SI volumes, with broker risk activity accounting for the difference.

As addressable SI volumes have increased, there has been a corresponding decrease in lit MTF activity, alongside a drop in dark MTF trading volumes (due to the DVCs coming into force). Some of this activity has found its way onto the Periodic Auction platforms (of which there are now seven operating in Europe, including Turquoise Plato Lit Auctions). These new platforms now account for approximately €1bn of daily EU trading activity.

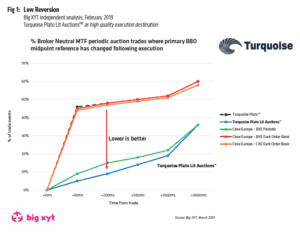

These channels have evidently become a standard feature in brokers’ smart routing logics, in part due to the ability to trade in all order sizes with low market reversion outcomes (Fig 1). This is the same high quality of execution we have become used to seeing when trading in electronic Conditional Block venues like Turquoise Plato Block Discovery.

Lit exchange volumes in general have seen liquidity changes too, as some key member participants are actively involved in building out their bi-lateral liquidity provision capabilities through the SI regime. This is particularly the case during continuous trading periods where it has been estimated that EU lit exchange activity has dropped to just over 31% of overall volume versus 40% at the time of MiFID II go-live.

Importantly, however, there has been a corresponding significant increase in auction activity over the same period. With overall EU trading volumes in 2019 to date down versus the same period in 2018, in aggregate the proportion of business when taking into account this increase in auction activity (in particular the close) has remained reasonably consistent. In terms of trading UK names, London Stock Exchange accounts for approximately 70% share of the market which is broadly in line with 2018’s activity.

Why is this change in the distribution of liquidity provision important and what is the London Stock Exchange Group cash secondary market doing to help clients navigate the current environment?

Sitting right at the core of the cash equities trading ecosystem, understanding the evolving needs of clients and partnering through innovation remain fundamental to our liquidity proposition strategy.

The promotion of certain liquidity-seeking order types on-book at London Stock Exchange has yielded positive results and a renewed focus from brokers in targeting their usage. As a result, we’ve seen brokers incorporating these order types into their daily smart routing workflows. Take the use of iceberg orders for example. In early Q1 this year almost one third of the top 50 trades on London Stock Exchange were derived from the use of iceberg order functionality (excluding closing auction). In January 2019 alone some £6.8bn in value traded originated from iceberg orders.

Building blocks

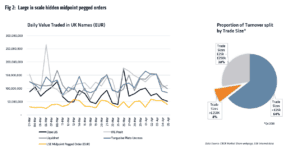

With a focus on brokers looking to trade using LIS functionality, the London Stock Exchange hidden mid-pegged order type is seeing further positive growth. This is an order which is required to be larger than LIS upon entry and is fully integrated with the orderbook to interact with both lit and dark contra, to source additional liquidity in a manner with is compatible with liquidity seeking algorithms.

While this is not a new feature, brokers are now pro-actively building the hidden mid-pegged order type into their smart order routing liquidity seeking toolkit. To date, some twenty London Stock Exchange member brokers have executed using the order type and there are up to a dozen actively participating on any given day. When considered as a LIS liquidity trading opportunity in its own right, daily volumes executed in UK names are now considered measurable against those LIS execution channels which specialise in providing electronic block liquidity (Fig 2).

The recently-launched London Stock Exchange auto-RFQ platform for equities, ETFs and Depository Receipts (DRs) is an example of further innovation, looking to bring together potentially the largest and most diverse range of liquidity provision including ELPs, banks, market makers and any member firm of London Stock Exchange onto a single electronic platform. The fully automated auto-complete RFQ platform uses MiFID II-compliant pre-trade transparency in order to offer meaningful trade sizes with the expectation of near immediacy of fill. It also requires no manual intervention throughout the trade lifecycle as it is designed so that it utilises pre-existing client electronic trading workflows.

Creating efficiency and aggregation in the search for liquidity as oppose further fragmentation of effort and resource is the goal for London Stock Exchange. Being a centrally cleared model we believe that London Stock Exchange’s RFQ platform also gives the opportunity for clients to gain access to liquidity provision which they may not otherwise be accessing. Trading membership of London Stock Exchange is the only pre-requisite to participation. This is a sell-side accessed model on behalf of the end investor. Functionality including the ability to control anonymous versus named routing and the self-ownership of counterparty polling further enriches the proposition without the need for bi-lateral counterparty connectivity costs, nor any potential concerns over counterparty risk.

Customer choice

Whilst the search for liquidity and the importance of smart order routing logics continues to prove a differentiator for brokers, the suite of liquidity channels offered not only by London Stock Exchange cash secondary markets but also Turquoise, complement each other by offering choice to clients (both members and non-members). Each liquidity channel, or order functionality can be utilised in combination depending on the liquidity compromise which often dictates routing behaviour, the pay-off between urgency and size.

Through one connection clients can access a complete set of liquidity channels from both London Stock Exchange and Turquoise, ranging from the primary central limit order book on London Stock Exchange and the Turquoise Lit MTF, where recent hardware refreshes have allowed for increased efficiency in messaging traffic and enhanced routing performance, through to dark block trading above large in scale via Turquoise Plato Block Discovery.

Integrated order types on London Stock Exchange’s orderbook including icebergs and the hidden mid-pegged order which, through the controlled use of Minimum Execution Sizes (MES) can deliver outsized fills, alongside Turquoise Plato Lit Auctions which cater for all trade sizes on a multi-lateral platform allow the successful navigation of the challenges the market faces in the new liquidity landscape.