Policymakers and regulators in the European Union (EU) and United Kingdom (UK) are in the midst of regulatory reviews aimed at enhancing liquidity and resilience in securities markets. These reviews point to the possibility of fragmentation in regulation across the two jurisdictions, although both are moving forward with plans for a consolidated tape. A series of outages in 2020 focussed attention on reforms needed to build equity market resilience. Some commentators propose the adoption of a more prescriptive regulatory framework like the US Regulation National Market System (Reg NMS). In this context, the Plato Partnership commissioned Professor Carole Comer- ton-Forde to undertake research on the merits of a Reg NMS-type framework in Europe.

Policymakers and regulators in the European Union (EU) and United Kingdom (UK) are in the midst of regulatory reviews aimed at enhancing liquidity and resilience in securities markets. These reviews point to the possibility of fragmentation in regulation across the two jurisdictions, although both are moving forward with plans for a consolidated tape. A series of outages in 2020 focussed attention on reforms needed to build equity market resilience. Some commentators propose the adoption of a more prescriptive regulatory framework like the US Regulation National Market System (Reg NMS). In this context, the Plato Partnership commissioned Professor Carole Comer- ton-Forde to undertake research on the merits of a Reg NMS-type framework in Europe.

The research has four objectives: (i) to inform European market participants and regulators about Reg NMS and the current equities landscape; (ii) to evaluate the strengths and weaknesses of Reg NMS; (iii) to explore its suitability for European markets; and (iv) to consider whether Reg NMS contributes to US market resilience. The research evaluates the academic literature on Reg NMS and syntheses the perspectives of buy-side and sell-side traders in Europe and the US.

The research concludes that Reg NMS is not desirable for Europe. The research recommends that more rigorous monitoring and accountability for best execution, aided by enhanced data (from a consolidated tape) and dis- closures, can achieve the same regulatory goals without risking unintended consequences that come with fundamental market reforms. You can read the complete paper on the Plato website. Below is a summary of Reg NMS, the US equities landscape and the strengths and weaknesses of this regulatory framework.

Reg NMS and the US equities landscape

Reg NMS transformed the US equities market. Introduced in 2007, it is a highly prescriptive set of rules aimed at promoting competition between markets whilst enabling interactions between buyers and sellers in a unified system. Its goal was to enhance the liquidity and efficiency of the equities market.

Reg NMS comprises twelve rules, of which eight were in place pre-Reg NMS. The central plank of Reg NMS is Rule 611 which prohibits “trade-throughs” – the execution of trades at prices inferior to those publicly displayed on other venues. The rule applies only to orders at the “top of the book.” The other rules are: (i) the access rule which imposes restrictions on trading fees; (ii) market data rules which ensure data are available to make informed and timely routing decisions; and (iii) the sub-penny rule which sets the minimum price variation.

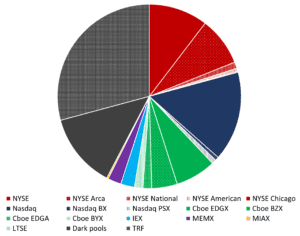

Pre-Reg NMS, trading was concentrated on two exchanges: the NYSE and the Nasdaq. Today trading is extremely fragmented: split across 16 exchanges, 32 dark pools and over 200 wholesale market makers. Figure 1 reports US trading activity by venue. Twelve exchanges, owned by three exchange groups: the NYSE, the Nasdaq and Cboe, account for 58% of market share. The largest single venue captures only 16% market share, and the smallest nine less than 2% each. Brokers must be able to directly or indirectly access all exchanges. Dark pools account for 13% market share, and the remaining 30% is executed over the counter, which includes most retail order flow. The main difference in the exchange trading models are their fee structures, which are extremely complex. Different order types have proliferated to enable traders to manage fees and avoid locking and crossing prices across markets.

Strengths and weaknesses of Reg NMS

Academic literature evaluating the overall impact of Reg NMS shows it was beneficial for market quality. However, its impact depends on stock size: large market capitalisation stocks were the main beneficiaries of the rule changes; while small-cap stocks experience lower turnover, larger trade sizes, larger spreads and worse pricing efficiency relative to larger firms. Theoretical research shows the trade-through rule distorts competition between venues, benefiting illiquid venues by providing an implicit subsidy, encouraging excessive fragmentation. Theory predicts that the introduction of a trade-through rule in an already fragmented market, such as Europe, will reduce investor welfare. Empirical evidence also shows that the trade-through and access rules potentially introduce trading frictions. Exchange routing mandated by Reg NMS leads to worse net prices, encouraging traders to manage their own routing decisions which requires subscriptions to proprietary data feeds. Complexity of order types provides advantages to short-term informed traders over uninformed and long-term informed traders. The access and sub-penny rules advantage dark pools over exchanges incentivising the use of dark venues.

Exchange fee structures are anti-competitive and exchange rebates create potential conflicts of interest for brokers. More venues also increase the cost of market data, connectivity, and co-location services. The perceptions and experiences of buy- and sell-side traders are mostly aligned with the academic evidence. Traders indicate the trade-through rule makes it easier to demonstrate best execution and acts as an important guard- rail. However, its prescriptive nature reduces flexibility in managing order flow. It also incentivises investment in speed and market data which increase costs. A consolidated tape without a trade-through rule would provide useful reference prices for post-trade analytics, without limiting trader flexibility. Traders also dislike the complexity of the exchange fee models, and proliferation of order types in the US, but are positive about the innovation offered by ATSs, which have more flexibility in how they operate.

To read the full report, click here.