Price formation is not simply about mirroring the prices set on primary regulated exchanges.

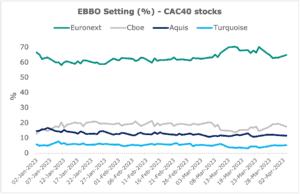

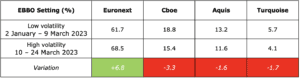

What is important is how frequently a trading venue improves the consolidated European Best Bid and Offer (EBBO). Looking at how often the different trading venues in Europe improve the consolidated EBBO, Euronext is the undisputed venue for price formation for the seven European markets it operates.

To measure price formation on a venue, the indicator that truly matters is the EBBO Setting percentage per venue – that is, the percentage of occurrences at which new EBBO improvements are set. In contrast, EBBO Presence cannot be used to demonstrate the price formation contribution of any venue, as this can simply be an indicator of the ‘copy and paste’ capability of MTFs versus primary exchanges.

Taking French blue-chip equities as an example, Euronext sets the best prices three to ten times more frequently than the main MTFs (65% compared to less than 20%), displays the largest notional liquidity available at the EBBO, and captures the highest share of trading on domestic equities. These are all indicators of true price formation. Source: BMLL Technologies, data on CAC 40 stocks

Source: BMLL Technologies, data on CAC 40 stocks

Euronext also guarantees the lowest implicit costs compared to MTFs in terms of spread at touch, spread at depth, and markouts after the execution of a trade.

Looking across the full spectrum of mid and small caps, it becomes even clearer that Euronext is the venue for price formation, as MTFs provide low or zero liquidity on those securities.

When volatility hits and when quality matters most, market participants find in Euronext and other regulated primary venues a ‘safe haven’ for trading

The price-forming role of Euronext is even more evident in periods of high volatility. Here are some examples analysing data from independent providers:

- Despite the volatility shock and market quality deterioration across all venues due to Covid waves in 2020, Euronext showed stronger resiliency than MTFs. Euronext maintained EBBO Setting above 60%, which was two to six times higher than MTFs across different volatility buckets.

- After the Ukraine-Russia geopolitical crisis began in early 2022, Euronext again displayed stronger price improvement metrics. Euronext was able to lead with 66% EBBO Setting, while the MTFs were all at below 20%.

- More recently, the volatility spikes in March 2023 led to upticks in volumes across all trading venues. This was particularly concentrated on primary regulated exchanges, which represent ‘safe havens’ for market participants. Indeed, further improvement of Euronext EBBO Setting was observed.

Source: BMLL Technologies, data on CAC 40 stocks

Source: BMLL Technologies, data on CAC 40 stocksA noteworthy example is Friday 17 March 2023, a very active day for equity trading given the combination of intraday volatility swings, option expiries and index rebalancing. This testified again to the crucial role played by Euronext and regulated exchanges as venues for price formation:

- allowing for certainty and urgency of execution when volatility hits during continuous trading sessions, whilst guaranteeing lower markouts for market participants;

- representing the liquidity pool of reference on monthly options expiry dates;

- guaranteeing efficient uncrossing of institutional and quant flows during the closing auction, which becomes even more crucial ahead of major stock indices rebalancing.

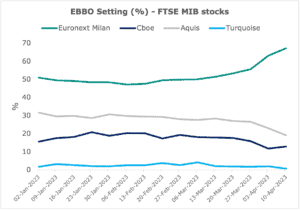

As further evidence, Euronext Milan recently experienced a significant improvement in market quality following the migration of Borsa Italiana cash markets onto Optiq® trading technology platform on 27 March 2023:

Euronext welcomes discussions on which metrics truly represent price formation, and why it is needed to offer orders pegged to the Primary BBO.