Severine Vandelanoite, senior vice president for products and regulation at Deutsche Börse AG

An additional trading opportunity

In the current equity trading landscape, closing auctions are an essential part of the trading session and have attracted significant volumes over the past years. The end of trading session is favoured by many market participants as it allows for concentration of liquidity over a few minutes, ensuring efficient price formation whilst considering all relevant available information.

The official closing price set during the price determination phase is the reference for market participants; it is used to calculate portfolio returns, evaluate the net asset values of mutual funds, and is used as a basis for many derivative contracts. Moreover, under MiFID II/MiFIR and the increased fragmented landscape, liquidity sourcing has become more difficult and closing auctions offer unmatched pools of liquidity coupled with accurate price discovery. Closing auctions are therefore considered as a pillar of market stability and investor protection.

Xetra Trade-at-Close is now an additional opportunity for market participants to trade at the official closing price on the leading market for German equities and the biggest market in Europe for ETFs. Trading during Trade-at-Close shows several benefits: market participants can roll over the orders which have not been executed during the closing auction because of an imbalance between the available bid and ask sizes in the order book; they get additional time to trade at the closing price if they missed the closing auction; Trade-at-Close is also the perfect opportunity to trade at fixed price without participating in the price formation process during the closing auction and also simply offers an additional opportunity to close out positions before the end of the trading session.

A simple market model

Xetra Trade-at-Close is a new trading session launched with T7 Release 9.0(1) in November 2020. It is enabled for all instruments on Xetra, including for blue chips, small and mid-caps but also for ETFs and ETPs. Trade-at-Close is triggered automatically as soon as the price determination has completed for the closing auction, meaning at 17:35CET (plus random walk scenario), and lasts a maximum of ten minutes, bringing the end of the trading session to 17:45CET. This last session starts only if the closing auction for the relevant instrument ended with a successful price determination with positive turnover and is only triggered after potential volatility interruptions and extended volatility interruptions took place.

*Closing auction has a randomised end, plus potential (extended) volatility interruption.

Continuous matching of market and limit orders…

Trade-at-Close accepts market and limit orders. While obviously market orders do not have a price limit, there is no requirement to submit limit orders with a price limit equal to the single matching price only: all limit orders with a price better than the closing auction price or a price equal to the closing auction price have the possibility to participate. Moreover, limit orders are not re-priced, their price limit only acts as a selection criterion for Trade-at-Close.

Designed to be as simple as possible, Trade-at-Close matches continuously market and limit orders according to time priority only and at the official closing price. This means that non executed orders rolled over from the closing auction have priority over the orders entered during Trade-at-Close. For the same reason, there is no priority given to market orders over limit orders, only the entry time matters in the priority ranking for execution.

… with full pre and post trade transparency…

Moreover, Trade-at-Close offers full pre and post trade transparency; available cumulated sizes as well as the number of orders present in the order book and activated for the session are displayed. Executed transactions are immediately published.

… and pricing aligned with other trading phases.

Easy to access, Trade-at-Close does not require any additional connectivity for Xetra members and benefits from the existing post trade infrastructure available on Xetra. There are also no additional costs compared to the existing trading phases on the platform: trades executed during Trade-at-Close are priced according to the price list applied for continuous trading, same as our opening, intraday and closing auctions on Xetra.

A customised participation

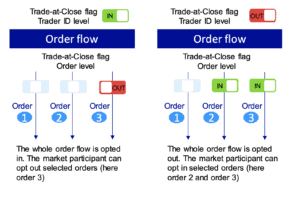

Figure: The order level flag supersedes the Trader ID flag

The participation in Trade-at-Close is optional: by default, orders submitted by market participants are not opted in Trade-at-Close, meaning that members shall actively flag their orders to ensure their participation in the new trading session. However, Xetra offers extended flexibility as members can decide to opt in their whole order flow or on an order-by-order basis; and it is always possible to modify the flag for a dedicated order as the order level Trade-at-Close flag supersedes the user level Trade-at-Close flag. This means for instance that if a member has not opted to send its whole flow to Trade-at-Close, he can still overwrite the flag for selected orders, without changing its general settings.(2)

Opted in limit orders and market orders entered during the trading session or during Trade-at-Close can participate in the session. When opted in Trade-at-Close, qualifying orders not filled in the closing auction will automatically be transferred to the Trade-at-Close phase. New orders can also be entered during Trade-at-Close and will only activate if the price limit is better than or equal to the closing auction price. Orders not participating in Trade-at-Close are not affected, and orders not executed during Trade-at-Close transfer to the next trading session or are deleted if Good For Day.

Integrated smoothly between the closing auction and the post trading phase, Xetra Trade-at-Close gives the opportunity to trade at the official closing price without additional costs compared to continuous trading and auctions on Xetra. The new session is available with only minimal adjustments to our members’ systems and algos and benefits from the reliable and robust post trade infrastructure of Deutsche Börse.

(1)See Xetra Market Model Release 9.0 for more information (www.xetra.com)

(2)Note that ETI New Orders Single (short message) do not have order level flagging.