There can be little doubt that 2016 has been a tumultuous year, not only in the wider world with the UK’s Brexit vote and Donald Trump’s surprise presidential election win, but also in the world of asset management, which has seen a swathe of senior departures.

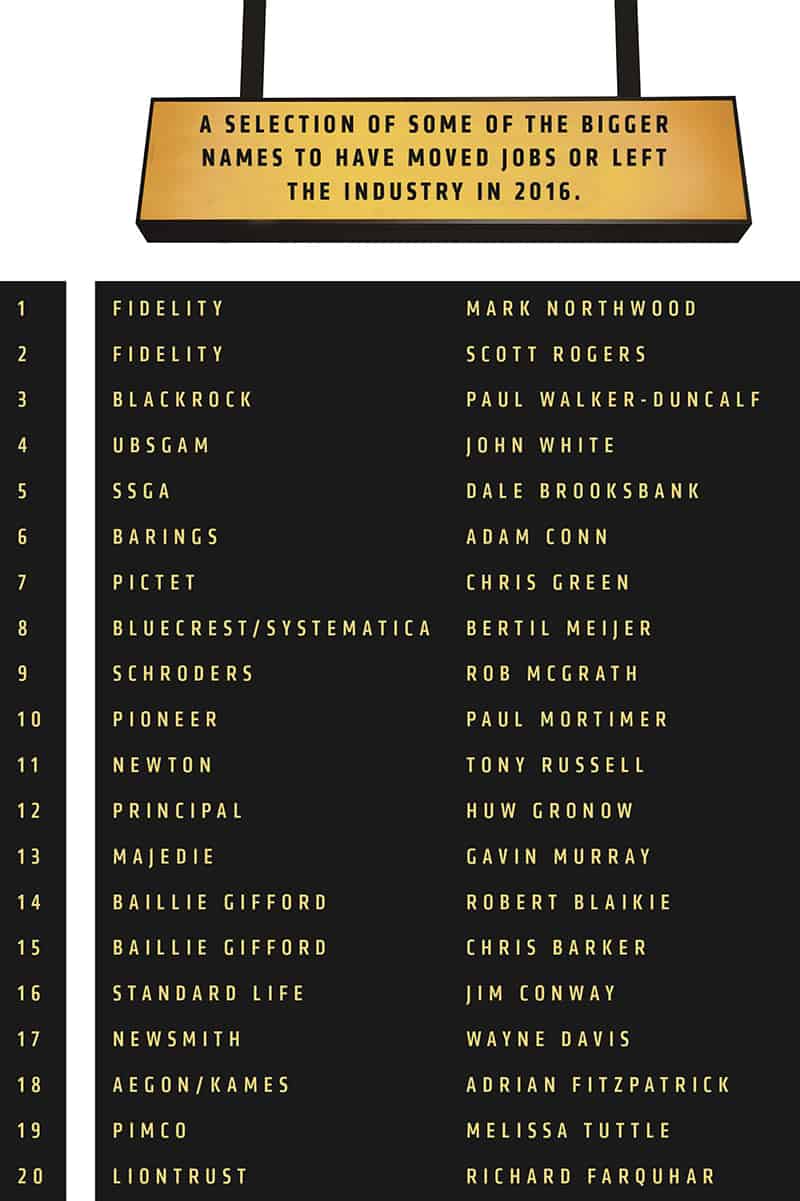

The TRADE has counted no fewer than 20 buy-side heads of desk or senior traders at big name firms leaving their jobs this year. The scale of the power vacuum at the top of the industry is unprecedented. However, we believe there are many more departures among the smaller asset managers as well that we simply don’t yet know about.

But what could be the cause of the huge talent exodus? The TRADE has been looking into this issue and readers will not be surprised to hear that regulation and technology are likely factors.

Regulatory Revolt

These days it is almost impossible to look at any industry developments without considering the role regulation has to play. While this has been a theme for many years, 2016 (and likely 2017) has been a crucial year for the buy-side as it struggles to get to grips with MiFID II in Europe and a variety of new regulations in the US.

One trader told The TRADE: “We’re seeing a far higher level of regulatory scrutiny than ever before and you’ve got to embrace the way things are moving if you want to get on in this industry. I think for some, the intense responsibility and scrutiny is simply too much, and they would prefer to move on to other roles where there’s less risk of getting it wrong.”

Anecdotal reports suggest that some senior traders have voluntarily opted to leave because they don’t want to face the barrage of regulatory scrutiny coming their way. However, others suggest some desk heads have been pushed out due to a reluctance to change their ways to adapt to the post-MiFID world.

Senior managers at asset management firms may be keen to reshuffle their trading teams to fill them with individuals who are more open to new ways of trading and who are less likely to be stalwarts of the old broker crossing network or sales-trader approaches.

Sell-side withdrawal

“It used to be that you just passed on responsibility to the sell-side, but today that’s much less feasible and the buy-side is increasingly expected to use sell-side tools to analyse and manage their trades,” a trader told us.

With brokers facing increased pressure not just from regulators but also their more challenging financial positions in the post-Lehmans era, they are increasingly scaling back the range of services they offer the buy-side. Where they were once one-stop-shops for all your trading needs, the increased complexity and cost of this approach means many brokers simply cannot afford to service the buy-side to the extent they once did and regulators are increasingly seeing buy-side over-reliance on brokers as a potential conflict of interest.

Of course, as alluded to above, this means the job of the average buy-side trader has become significantly more complex and carries far more responsibility than it may have done in the past. It is simply no longer possible for any trader to simply act as a conduit between PMs and brokers, they are increasingly required to have a broader range of analytical skills to provide PMs with expert advice and to thoroughly scrutinise the activities of their sell-side counterparts.

Teching up

Perhaps the biggest change for a buy-side trader over the past couple of decades is that they have become more masters of technology than masters of people. While in the past, building relationships with sales traders was one of the key skills required to trade securities, today those relationships have been largely replaced by machines.

For many, this is a change that is simply insurmountable. If you built your career on having the gift of the gab and the ability to read people to find the most trustworthy brokers around, or carefully working a large and complex order over the course of weeks to get the best result for your PM, you are likely to feel quite out of your depth in this new world. Having to invest millions in technology platforms and ensure the smooth running of machines that talk to each other thousands of times a second.

The pace of technological change in this industry has been immense and initially was driven by competitive pressures, as exchanges, banks and the buy-side all embraced the benefits of trading electronically by algorithm. While much of that change happened more than a decade ago, the industry is now seeing a second technological revolution driven partially by regulation, with a range of new tech covering reporting, data management, analytics and more driving major change in the skills required to run a trading desk. There is of course also the risk that, within the next decade, a fully AI trading desk may become a reality, removing the need for humans to ever trade again.

The tides of time

Of course not everyone is leaving because the industry is changing, some of this could very well be attributed to demographics. Many of the senior traders today come from a generation that came up since the Big Bang of banking deregulation in the 1980s and have arguably been the pioneers of many of the changes to both professionalism and complexity of securities trading over the years. Of course this means many of them have spent 40 years or more in industry and thus are simply thinking of retirement.

With these giants of the industry stepping down, there are also opportunities abound. A new generation of traders, some of which may never have known anything other than the electronic trading era, now need to step up and fill some very big shoes in the industry. The TRADE’s Rising Stars event in London in November demonstrated that there are plenty of willing and talented candidates out there, the goal for the wider industry is to make sure they get there and also look to ensure that new hires carry the skills needed to face this new era.

“The buy-side is increasingly looking at candidates who have high-level analytical skills, an interest in technology, maybe qualified in engineering, because these are the skills that really matter to the desk of the future,” as one head of desk told The TRADE.

We expect 2017 to continue in 2016s footsteps, with a lot of movement of people at the top of the industry as firms start getting ready for MiFID II and other regulations to come into force. We may find ourselves saying farewell to old friends, but let’s also remember this is an opportunity to welcome new faces and new points of view into the dynamic world of securities trading.