With the close now representing 21% of average daily volumes, the challenge of continuous intraday liquidity is leaving institutional asset managers searching for alternative sources of liquidity.

With the close now representing 21% of average daily volumes, the challenge of continuous intraday liquidity is leaving institutional asset managers searching for alternative sources of liquidity.

Although there have been recent efforts to improve access to the close, the question is whether other sources of activity such as retail flow also now represent a valuable liquidity opportunity.

The increase in retail flow and investor appetite for meme stocks captured headlines at the start of the pandemic, in particular in the US where the combination of COVID-19 related stimulus cheques together with reduced sport betting opportunities acted as a trigger for the public to focus their attention on capital markets. Europe has also seen an increase in retail.

The growth is evidenced by transaction results released by Equiduct, the pan-European retail-focused exchange, which has seen an 88% increase in average daily volumes (ADV) for 2020 reaching €283 million, up from €149 million in 2019.

While European activity remains smaller than the US, there is now a distinct trend emerging. The move to online trading on mobile apps will further spur retail investors’ appetite and tech savvy generations are growing accustomed to trading at their fingertips. This is particularly attractive given the zero return on cash savings versus the promise of ‘Zero-Cost fee’ trading.

Traditionally institutional traders have had little incentive to tap into this flow, given the relatively small order size and infrequency of trading. However, this now looks set to change: 48% of buy-side firms would like to engage with retail according to an outreach conducted by Redlap Consulting with 30 global heads of trading.

“We may get thousands of orders of 10 shares rather than one fill but it’s still in our interest as there is zero market impact and in certain FTSE 250 names it can represent 25-30% ADV – that’s liquidity we want to engage with,” said one large global asset manager.

The key differentiator to actively tap into retail flow will be automation. Asset managers engaging with retail service providers are fully aware of the smaller order size retail will offer. However, if the process is fully automated it no longer matters whether there is one or 100 clips, this is liquidity the buy-side needs and can engage with effectively.

Unlike the US, the retail market is fragmented. In the UK, most of the trades are executed via retail service providers off exchange, which are then printed on venue. In Europe, trades take place on national exchanges, while in Germany regional exchanges remain predominant. The question is who will be the providers of tomorrow’s retail liquidity that could help bridge the gap in the market between institutional and retail flow?

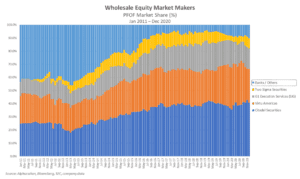

Market makers are also playing an active role in re-stitching the retail landscape by aggregating the bid positions they get from retail into a central risk book. Then they can interact with institutional investors in block liquidity either directly through Indication of Interest (IOIs) or indirectly via block venues. Recent data from Alphacution evidences the growing role market makers play in retail liquidity. In November 2020, market makers represented 90% of the payment for order flow (PFOF) market in the US, up from 60% in 2011.

The opportunity to better leverage retail flow is multi-faceted; at a time where intraday liquidity is drying up, asset managers need to find the other side of their trade. Liquidity providers that can bridge the gap in the market and remove the wall between institutional and retail liquidity will offer their clients improved access and opportunity to deliver best execution. This matters given the focus in the UK and Europe to channel more investments into small and mid-caps. Lack of liquidity in these stocks has long acted as the biggest deterrent for asset managers. The ability to access any retail interest in these names could help provide the liquidity asset managers need to be able to invest.

The use of PFOF continues to be heavily debated to ensure retail investors understand the lifecycle of their order and obtain the best possible outcome. While this remains predominantly a US phenomenon, European regulators should take notice; retail flow constitutes an undeniable part of capital markets and whether it is PFOF, retail service providers or neo brokers entering the European retail market, the market is in need of innovation to remove the remaining barriers between institutional and retail flow. It is only when multiple liquidity sources can interact together through better use of technology that capital markets will be able to support the real economy efficiently.