The International Organization of Securities Commissions (IOSCO) and the Financial Stability Board (FSB) have laid out its methodology for identifying non-bank non-insurer global systemically important financial institutions.

Its proposals could include asset managers and financial intermediaries such as brokers being deemed as “too big to fail”.

Since the financial crisis of 2008, ISOCO and the FSB have been looking at way to identify and reduce the risks posed by systemically important financial institutions (SIFIs) though its work has primarily focused on banks and insurers, both of which created serious problems for the global financial system in 2008 and beyond.

However, there has been ongoing discussion of how these rules could be applied to other major financial institutions.

The latest paper is the second on non-bank/insurer SIFIs and refines proposals on how to assess a potential SIFI following responses to its first consultation.

Though a number of asset managers had suggested during the first consultation that it was not appropriate to designate an asset manager as a SIFI, because they are not usually highly leveraged and their failure would not expose large swathes of the market to losses, they continue to fall within the scope of the proposed methodology.

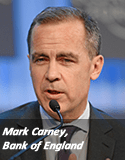

Mark Carney, chairman of the FSB and governor of the Bank of England, said: “The revised proposal marks an important step towards addressing any too big to fail problems amongst entities that are neither banks nor insurers. These include finance companies, market intermediaries, investment funds and asset managers. It will also enhance authorities’ understanding of the risks to global financial stability posed by the activities of entities in financial markets, including the distress or disorderly failure of non-banks and non-insurers”

Currently, two options to designate asset managers as SIFIs based on their assets under management have been put forward. The first is those with $100 billion in balance sheet total assets. The second those with $1 trillion in assets under management. For broker-dealers, the designation is set at those with $100 billion in balance sheet total assets.

Responding to suggestions that asset managers have little impact on wider markets when they fail, the report said: “an asset manager that faces distress or forced failure could, in certain circumstances, potentially cause or amplify significant disruption to the global financial system and economic activity across jurisdictions”.

Responses to the consultation should be submitted by 29 May 2015 and a final methodology for assessing non-bank/insurance SIFIs is expected to be published before the end of 2015.